Question: This year, Pau's distributive share from Silver & Black Partnership includes $2,173 of interest income, $3,156 of net long-term capital gains, $3,984 net section

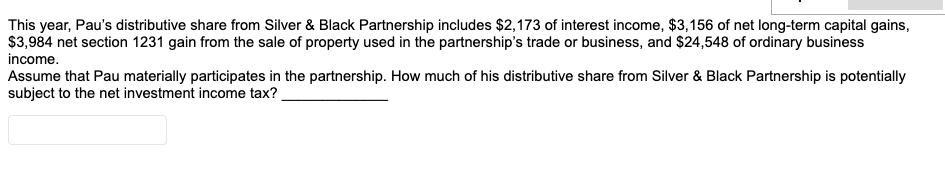

This year, Pau's distributive share from Silver & Black Partnership includes $2,173 of interest income, $3,156 of net long-term capital gains, $3,984 net section 1231 gain from the sale of property used in the partnership's trade or business, and $24,548 of ordinary business income. Assume that Pau materially participates in the partnership. How much of his distributive share from Silver & Black Partnership is potentially subject to the net investment income tax?

Step by Step Solution

3.51 Rating (154 Votes )

There are 3 Steps involved in it

Answer Compute distributive share of the person Pau from the partn... View full answer

Get step-by-step solutions from verified subject matter experts