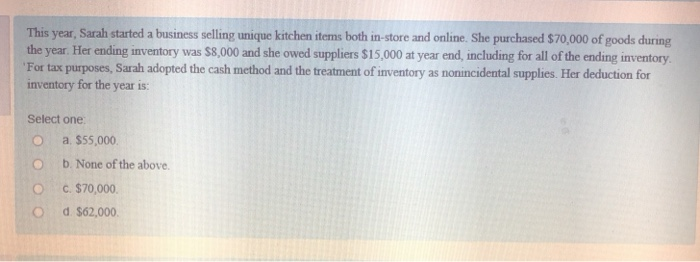

Question: This year, Sarah started a business selling unique kitchen items both in-store and online. She purchased $70,000 of goods during the year Her ending inventory

This year, Sarah started a business selling unique kitchen items both in-store and online. She purchased $70,000 of goods during the year Her ending inventory was $8,000 and she owed suppliers $15,000 at year end, including for all of the ending inventory For tax purposes, Sarah adopted the cash method and the treatment of inventory as nonincidental supplies. Her deduction for inventory for the year is: Select one O a $55,000 b None of the above. C. $70,000. Od $62,000

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock