Question: This year, Sigma, Incorporated generated $ 6 7 7 , 2 5 0 income from its routine business operations. In addition, the corporation sold the

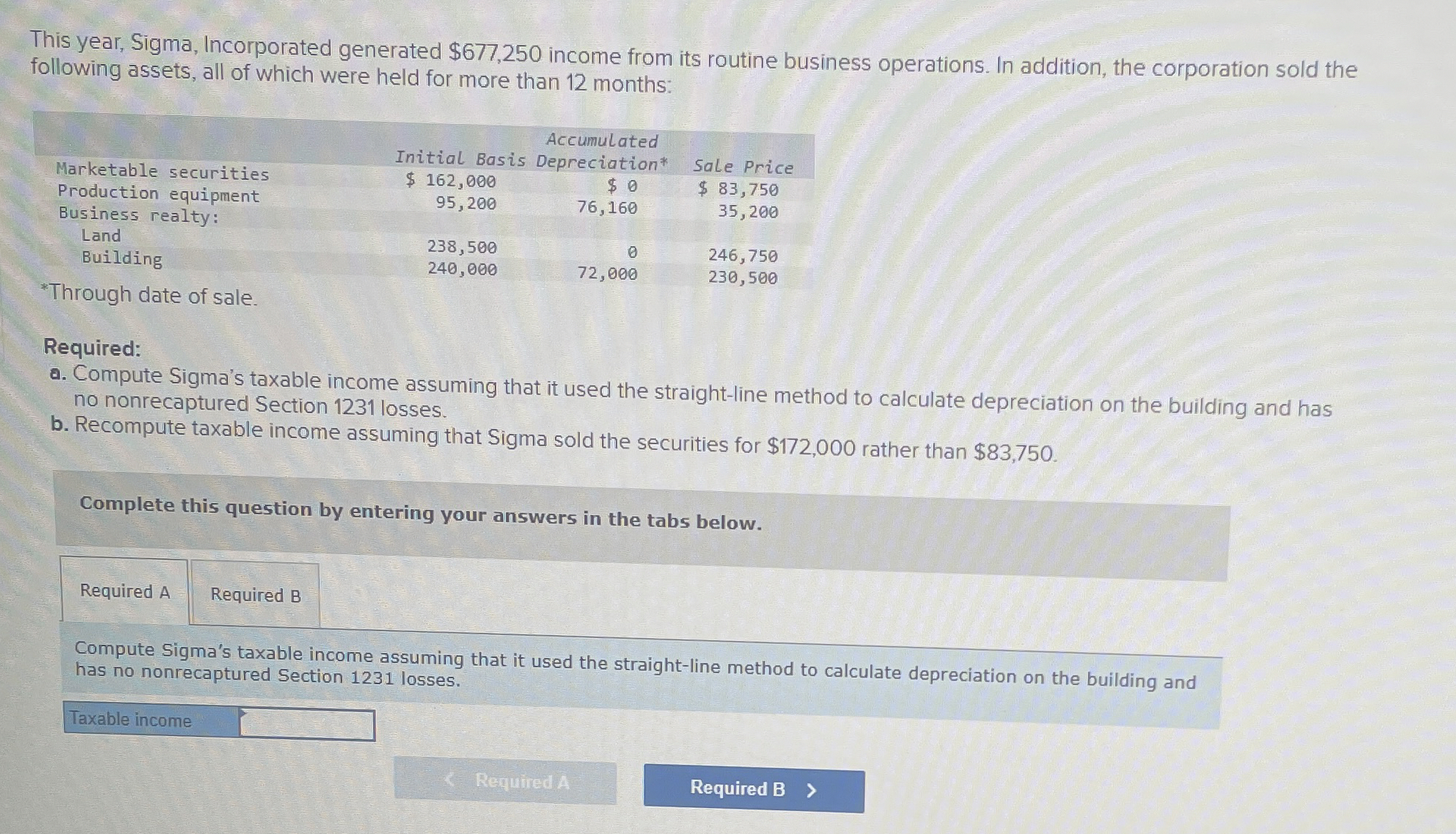

This year, Sigma, Incorporated generated $ income from its routine business operations. In addition, the corporation sold the following assets, all of which were held for more than months:

tableAccumulatedMarketable securitiesInitial Basis,DepreciationSale Price,Production equipment,$$$Business realty:,LandBuilding

Through date of sale.

Required:

a Compute Sigma's taxable income assuming that it used the straightline method to calculate depreciation on the building and has no nonrecaptured Section losses.

b Recompute taxable income assuming that Sigma sold the securities for $ rather than $

Complete this question by entering your answers in the tabs below.

Required A

Required B

Compute Sigma's taxable income assuming that it used the straightline method to calculate depreciation on the building and has no nonrecaptured Section losses.

Taxable income

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock