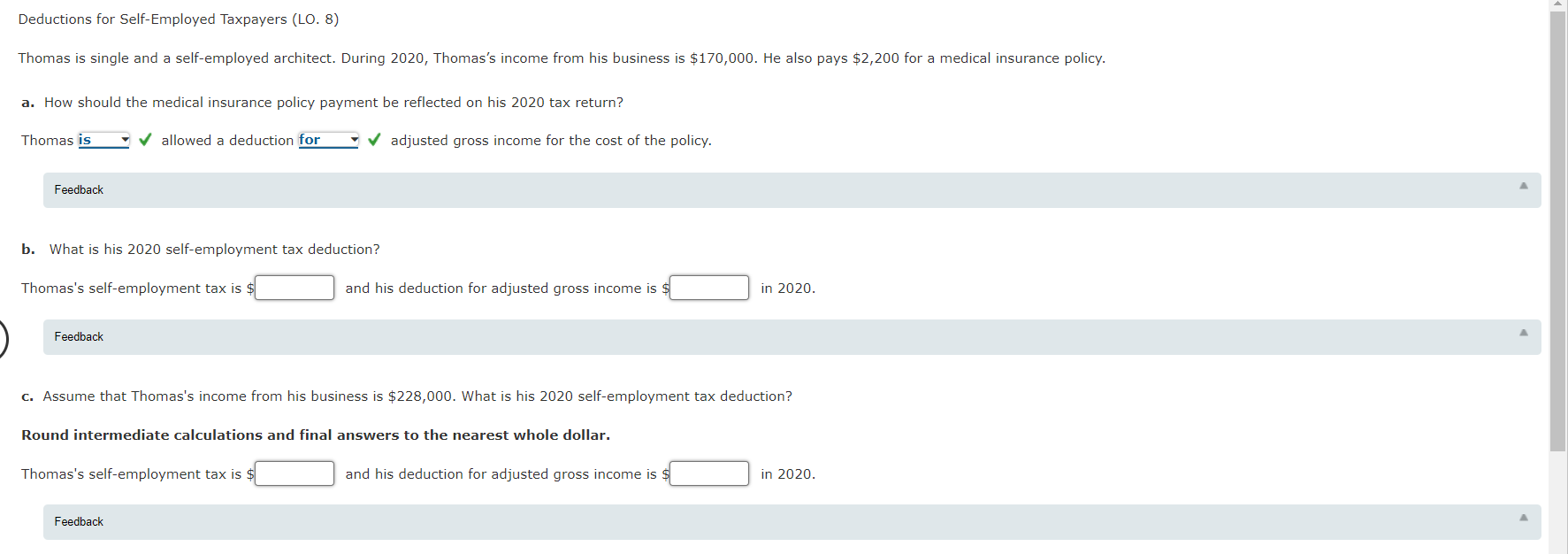

Question: Thomas is single and a self-employed architect. During 2020, Thomass income from his business is $170,000. He also pays $2,200 for a medical insurance policy.

Thomas is single and a self-employed architect. During 2020, Thomass income from his business is $170,000. He also pays $2,200 for a medical insurance policy.

a. How should the medical insurance policy payment be reflected on his 2020 tax return?

Thomas is allowed a deduction for adjusted gross income for the cost of the policy.

b. What is his 2020 self-employment tax deduction?

Thomas's self-employment tax is $ and his deduction for adjusted gross income is

$ in 2020.

c. Assume that Thomas's income from his business is $228,000. What is his 2020 self-employment tax deduction?

Round intermediate calculations and final answers to the nearest whole dollar.

Thomas's self-employment tax is $ and his deduction for adjusted gross income is $ in 2020.

I want to know how to answer B and C.

And this information is what I received from the question.

Please help me.

Deductions for Self-Employed Taxpayers (LO. 8) Thomas is single and a self-employed architect. During 2020, Thomas's income from his business is $170,000. He also pays $2,200 for a medical insurance policy. a. How should the medical insurance policy payment be reflected on his 2020 tax return? Thomas is allowed a deduction for adjusted gross income for the cost of the policy. Feedback b. What is his 2020 self-employment tax deduction? Thomas's self-employment tax is $ and his deduction for adjusted gross income is $ in 2020. Feedback C. Assume that Thomas's income from his business is $228,000. What is his 2020 self-employment tax deduction? Round intermediate calculations and final answers to the nearest whole dollar. Thomas's self-employment tax is $ and his deduction for adjusted gross income is $ in 2020. Feedback

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts