Question: Thomas Taylor, Vaughn & Chris's controller, has received all the budgets prepared by the various operating units and is ready to compile the pro

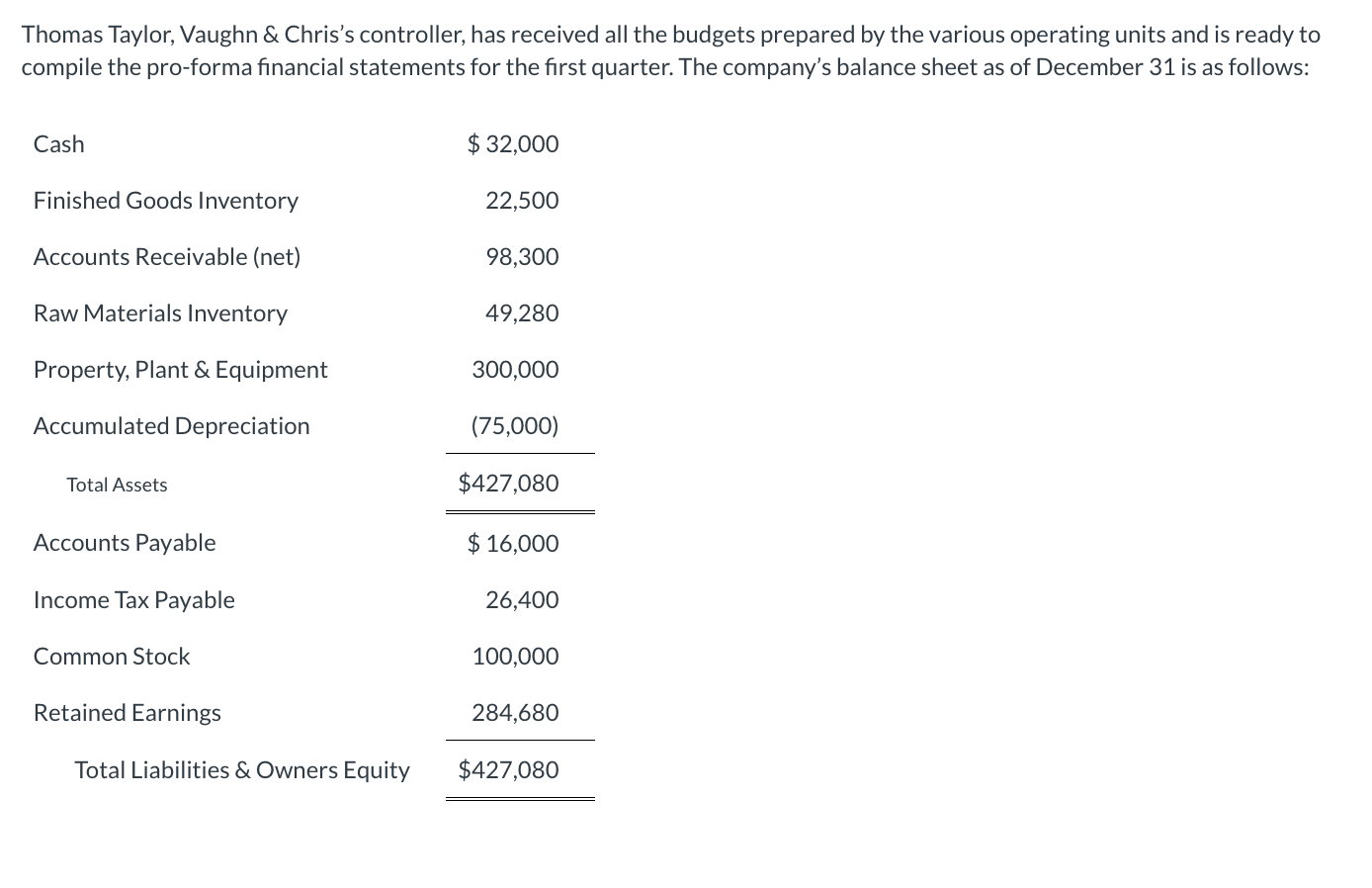

Thomas Taylor, Vaughn & Chris's controller, has received all the budgets prepared by the various operating units and is ready to compile the proforma financial statements for the first quarter. The company's balance sheet as of December is as follows:

Additional Information:

Vaughn & Chris plans to purchase and pay cash for a piece of land in February at a cost of $

Vaughn & Chris plans to purchase equipment in March at a cost of $

Depreciation for manufacturing overhead $ per quarter and for selling and administrative $ per month.

The company expects a income tax rate, and all quarterly taxes are paid in the first month of the following quarter. Prepare Vaughn & Chris's proforma income statement for the first quarter. Enter negative amounts using either a negative sign preceding the number eg or parentheses eg

Vaughn& Hill Income Statement

First Quarter

$

Income Before Taxes

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock