Question: Thoroughly read the case. It is recommended that you read 2-3 times. Prepare a 5-page report (12-point font, double spaced not including the title page

- Thoroughly read the case. It is recommended that you read 2-3 times.

- Prepare a 5-page report (12-point font, double spaced not including the title page or reference page), that addresses the following questions:

- Describe the industry in which Organigram is operating.

- What factors contribute to the ambiguity faced by Organigram?

- What possibilities currently exist for Organigram to grow? Will they change with legalization and if so how?

- What evaluation criteria should Organigram use when assessing growth options while keeping in mind the recommendations from the Task Force?

- What would you recommend Organigrams next steps be?

- What changes may occur within the industry that may impact Organigrams growth?

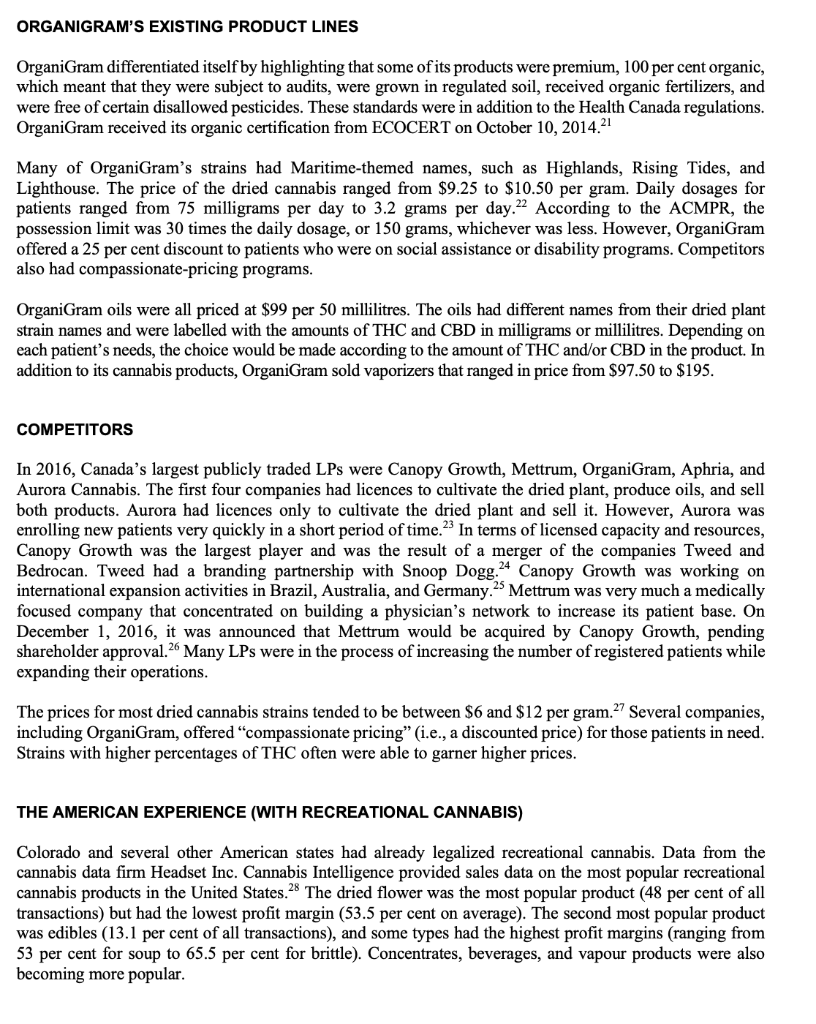

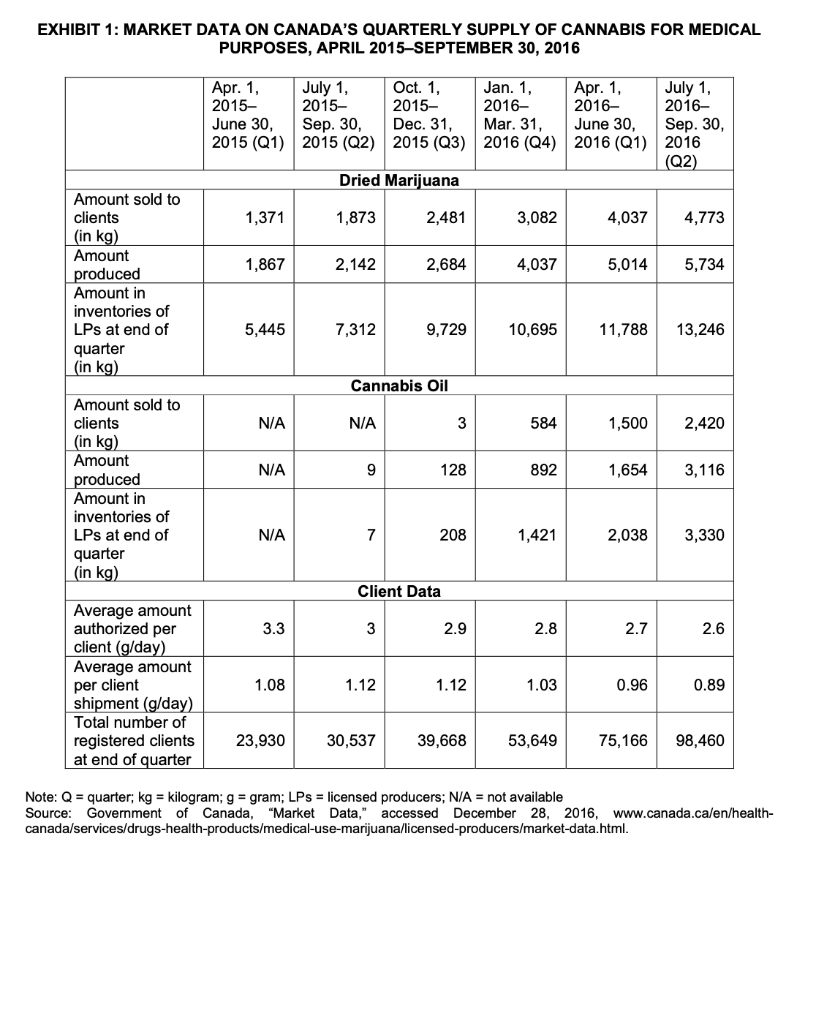

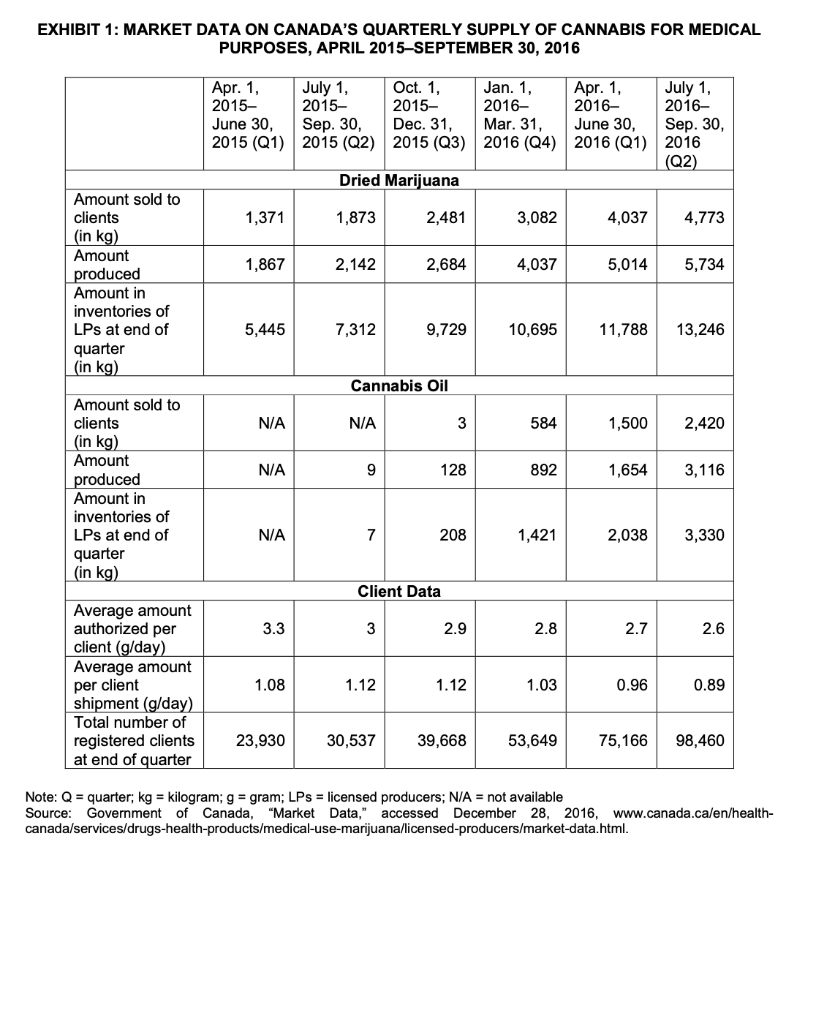

ORGANIGRAM: NAVIGATING THE CANNABIS INDUSTRY WITH "GREY KNOWLEDGE" Opal Leung wrote this case solely to provide material for class discussion. The author does not intend to illustrate either effective or ineffective handling of a managerial situation. The author may have disguised certain names and other identifying information to protect confidentiality This publication may not be transmitted, photocopied, digitized, or otherwise reproduced in any form or by any means without the permission of the copyright holder. Reproduction of this material is not covered under authorization by any reproduction rights organization. To order copies or request permission to reproduce materials, contact Ivey Publishing, Ivey Business School, Western University, London, Ontario, Canada, N6G ON1; (t) 519.661.3208; (e) cases@ivey.ca; www.iveycases.com. Copyright 2017, Richard Ivey School of Business Foundation Version: 2017-08-09 From our strategic point of view, we are interested in jumping into the recreational marketplace just because of its size and breadth ... we expect ourselves and most of the LPs [licensed producers] will probably play on both sides of the fence, medicinal and recreational ... assuming, and I'm sure that it will, that the medicinal marketplace will continue to thrive, even when the recreational marketplace comes forward. Larry Rogers, chief operating officer, OrganiGram On December 1, 2016, the Task Force on Cannabis Legalization and Regulation (the Task Force) released its final report.' It was the result of a long process of consulting with many stakeholders, including patients, various levels of government, and experts across Canada and the United States. The Task Force was assembled in June 2016, soon after the Trudeau government announced on April 20, 2016) that legislation to legalize recreational cannabis would be introduced in the spring of 2017 with the intention of having it become law in the spring of 2018. Several cannabis companies, including OrganiGram Holdings Inc., Canopy Growth Corporation, Aphria Medical Marijuana, Mettrum Ltd., and Aurora Cannabis Inc., had already been supplying medical cannabis to patients in Canada. The size of the recreational market was predicted to be approximately $5 billion? and up to $22.6 billion if including the ancillary market (e.g., testing labs, security, and paraphernalia)." With the potential to sell its product to this new market, the New Brunswick-based cannabis company OrganiGram had already begun to prepare for expansion into the recreational market, even before the government's announcement was made. However, there were still several unknowns that made the cannabis industry's environment ambiguous. What would the timeline for legalization be? Who would be allowed to grow cannabis and how much? Would there be any safety regulations to ensure that customers would receive safe recreational products? Would there be regulations for drivers who medicated with and drove under the influence of cannabis? Which part of the Task Force report recommendations would actually become a reality? From a marketing perspective, if the current cannabis companies were known as providers of pharmaceutical-grade cannabis, was it possible to adjust their brand to attract recreational users? If so, how would they do it? According to OrganiGram chief operating officer Larry Rogers, several decisions had to be made based on "grey knowledge. Even though the Task Force had released its report, it was still unclear which suggestions the federal government would adopt. CANNABIS REGULATIONS IN CANADA The Marihuana for Medical Purposes Regulations (MMPR) were enacted under the Controlled Drugs and Substances Act in July 2013. Before the MMPR, the Marihuana Medical Access Regulations, enacted in 2001 and repealed in 2013, allowed patients to grow their own cannabis plants or have someone grow the plants for them. The MMPR was an attempt to control the production and distribution of medical cannabis, with licensed producers (LPs) being the only companies authorized by Health Canada to cultivate and/or sell dried cannabis to patients who had prescriptions. The application process was very rigorous and, as a result, a low percentage of applicants were granted licences. As of August 1, 2016, 1,561 applications had been received, 253 had been refused, 419 were in progress, 54 had been withdrawn, and 801 were incomplete." As of December 28, 2016, only 37 licences had been issued, with most of them in Ontario (22) and British Columbia (8). Some companies had more than one licence, which meant that they had more than one site because each licence was location-specific. Patients could legally register and buy their medical cannabis at only one LP for each prescription. A subset of the LPs also had licences to produce and/or sell fresh cannabis seeds or cuttings and cannabis oil, with some companies holding more than one licence. Twenty-two licences for producing and/or selling cannabis oil were held by only 18 companies. The authorization to produce and sell oils and fresh plant material meant that companies could create and sell other products, such as cloned strains (clones) of cannabis (i.e., starter plants). LPs were required to keep detailed records of all cannabis received (including the name of the seller, the date and place of the transaction, and a full description of the product). In the Task Force report, one of the recommendations was to implement a seed-to-sale tracking system. The oils made by LPs were better for dosing than homemade oils because the amount of tetrahydrocannabinol (THC) and/or cannabidiol (CBD) could not be clearly determined in the latter. For example, when a patient smoked a joint made from dried cannabis, it was unclear how much THC was being inhaled. However, when using cannabis oil, the dosage was measured by volume. When the Access to Cannabis for Medical Purposes Regulations (ACMPR) was passed in August 2016, patients were once again allowed to grow their own cannabis plants. Some LPs started selling clones to patients.? The ACMPR permitted companies to sell oil in a "capsule or similar dosage form but not edibles marijuana infused food products. OrganiGram was still in the research and development stage of capsule production. However, the ACMPR allowed patients to "alter the chemical or physical properties of the fresh or dried marihuana or cannabis oil, meaning that patients could make their own edibles. OrganiGram patients received a copy of Aunt Sandy's Medical Marijuana Cookbook as part of their client welcome kit. OrganiGram was the only LP on Canada's east coast that had licences to cultivate (i.e., grow and process) dried cannabis, produce fresh cannabis and cannabis oil, and sell all of these products. The first few LP licences were granted in 2013." Its licences permitted it to produce up to 1,500 kilograms of dried cannabis and 500 kilograms of cannabis oil and sell up to 1,200 kilograms of dried cannabis and 500 kilograms of cannabis oil per year, within Canada." Also, medical cannabis plant cuttings and dried buds could be sold and shipped to other LPs on a wholesale basis. The only other LP in the Maritimes was Canada's Island Garden Inc. (CIGI) in Prince Edward Island. However, CIGI had a licence only to cultivate dried cannabis. OrganiGram received its licence to cultivate dried cannabis on March 26, 2014, and received its oil licence on July 23, 2016. CIGI was licensed to cultivate dried cannabis on June 16, 2016. The first licences to produce and sell cannabis oils were granted in the summer of 2015.13 ORGANIGRAM COMPANY BACKGROUND OrganiGram was founded in 2013 in Moncton, New Brunswick. In 2014, there were only approximately 17 staff members. The company employed 70 people as of December 2016, and it was looking forward to expanding its workforce up to about 170 staff in the next year or two to staff its new and expanding facilities. The organizational structure consisted of three levels: the C-suite (i.e., chief executive officer, chief operating officer, chief financial officer, and chief commercial officer), directors, and employees in various functions (e.g., garden workers and client support). Its facilities consisted of a main facility, a newly acquired building next to the main facility, and the adjoining 10-acre (4.1-hectare) property with a 136,000- square-foot (12,635-square-metre) industrial building. In addition to being the first medical cannabis company in the Maritimes to be licensed to grow and sell medical cannabis, it was a certified organic medical cannabis producer. This organic certification meant that it needed to follow more rules than most of its competitors. Canada had only three organic LPs. Organigram was the only Maritime cannabis company with licences to cultivate, produce, and sell cannabis products. In a Canadian Broadcasting Corporation report, it was announced that at the end of March 2016, the New Brunswick government awarded payroll rebates of up to $990,000 over three years to OrganiGram to help create up to 113 new jobs in the province." Chief executive officer Denis Arsenault stated, We are from New Brunswick and we're excited to invest at home, where the advantages of a well-educated work force, low power rates and a competitive cost of living make New Brunswick and Moncton a logical place for our future 16 In the summer of 2016, Organigram purchased a new building in Moncton. In an interview published on October 25, 2016, chief commercial officer Ray Gracewood stated that much of the space in the new facility in Moncton would be for the manufacturing of edibles and extracts."? To finance its expansion plans, OrganiGram announced the closing of a $40 million bought deal on December 7, 2016, to finance an expansion of its existing facility for an additional 32,000 square feet (2,973 square metres) of grow-room area and continue with its planned cannabis oil extracts and derivatives facility. 18 In this bought deal, a group of investment firms (led by Dundee Securities Ltd.) offered $40,253,450 for 11,339,000 shares at a price of $3.55 per share to Organi Gram. 19 THE PROCESS OF PRODUCING CANNABIS PRODUCTS The process of growing and processing cannabis started with purchasing and receiving materials such as soil and fertilizers. Cuttings taken from mother plants were started in the nursery to grow clones, which were put into pots of soil for the pre-vegetative (pre-veg) process. The process of growing plants from clones had two benefits: (1) it took less time than growing from seeds and (2) it ensured that the plants would have the same characteristics as the mother plant. The pre-veg process took several weeks, as did the vegetative process, which began when the plants were set into larger pots. Next, the plants were placed in grow rooms for the flowering stage, which took 56-72 days. After harvesting, the cannabis was trimmed, dried, cured, and packaged for mailing to patients. Organi Gram had produced and posted a YouTube video that described the growing process.2 According to Rogers, it could take over six months from starting the clones to packaging the final product. Under the ACMPR, LPs were permitted to sell cannabis products only to patients directly through mail order or to other LPs on a wholesale basis. ORGANIGRAM'S EXISTING PRODUCT LINES Organigram differentiated itself by highlighting that some of its products were premium, 100 per cent organic, which meant that they were subject to audits, were grown in regulated soil, received organic fertilizers, and were free of certain disallowed pesticides. These standards were in addition to the Health Canada regulations. OrganiGram received its organic certification from ECOCERT on October 10, 2014.21 Many of OrganiGrams strains had Maritime-themed names, such as Highlands, Rising Tides, and Lighthouse. The price of the dried cannabis ranged from $9.25 to $10.50 per gram. Daily dosages for patients ranged from 75 milligrams per day to 3.2 grams per day.22 According to the ACMPR, the possession limit was 30 times the daily dosage, or 150 grams, whichever was less. However, OrganiGram offered a 25 per cent discount to patients who were on social assistance or disability programs. Competitors also had compassionate-pricing programs. OrganiGram oils were all priced at $99 per 50 millilitres. The oils had different names from their dried plant strain names and were labelled with the amounts of THC and CBD in milligrams or millilitres. Depending on each patient's needs, the choice would be made according to the amount of THC and/or CBD in the product. In addition to its cannabis products, OrganiGram sold vaporizers that ranged in price from $97.50 to $195. COMPETITORS In 2016, Canada's largest publicly traded LPs were Canopy Growth, Mettrum, OrganiGram, Aphria, and Aurora Cannabis. The first four companies had licences to cultivate the dried plant, produce oils, and sell both products. Aurora had licences only to cultivate the dried plant and sell it. However, Aurora was enrolling new patients very quickly in a short period of time.2 In terms of licensed capacity and resources, Canopy Growth was the largest player and was the result of a merger of the companies Tweed and Bedrocan. Tweed had a branding partnership with Snoop Dogg:24 Canopy Growth was working on international expansion activities in Brazil, Australia, and Germany.25 Mettrum was very much a medically focused company that concentrated on building a physician's network to increase its patient base. On December 1, 2016, it was announced that Mettrum would be acquired by Canopy Growth, pending shareholder approval.26 Many LPs were in the process of increasing the number of registered patients while expanding their operations. The prices for most dried cannabis strains tended to be between $6 and $12 per gram.27 Several companies, including OrganiGram, offered compassionate pricing (i.e., a discounted price) for those patients in need. Strains with higher percentages of THC often were able to garner higher prices. THE AMERICAN EXPERIENCE (WITH RECREATIONAL CANNABIS) Colorado and several other American states had already legalized recreational cannabis. Data from the cannabis data firm Headset Inc. Cannabis Intelligence provided sales data on the most popular recreational cannabis products in the United States.28 The dried flower was the most popular product (48 per cent of all transactions, but had the lowest profit margin (53.5 per cent on average). The second most popular product was edibles (13.1 per cent of all transactions), and some types had the highest profit margins (ranging from 53 per cent for soup to 65.5 per cent for brittle). Concentrates, beverages, and vapour products were also becoming more popular. According to a 2016 report by the Rocky Mountain High Intensity Drug Trafficking Area on marijuana in Colorado, the established demand in 2014 was 121.4 metric tons for residents (aged 21 years and older) and the estimated demand was 8.9 metric tons for out-of-state visitors (aged 21 years and older). The same report noted 485,000 regular users of cannabis in Colorado. The total population of Colorado was 5.36 million. Based on data collected on approximately 40,000 legal (recreational) cannabis purchases, cannabis users spent an average of US$647 annually in Washington State. 30 Thousands of jobs and millions of dollars collected in taxes were reported in Colorado. According to Rogers, Colorado "is like the gold standard for recreational marijuana in the world. It's the only place of size that has had a recreational marketplace for more than a short period of time ... at least they have some quantifiable data that you can try and use to project forward. However, regulations were very different in the United States and varied from state to state. For example, the state law in Colorado permitted licensed retailers to sell only up to 30 per cent of their total finished Retail Marijuana inventory" to other licensed establishments." Because marijuana was still illegal at the federal level, it was difficult for American cannabis businesses to open bank accounts and many used only cash transactions. CHALLENGES In September 2016, OrganiGram partnered with TGS International LLC, a firm in Colorado that had experience with manufacturing and selling edibles, which were not yet legal to sell in Canada. According to Rogers, the TGS partnership was meant to help OrganiGram "spin up its edible-marijuana manufacturing facilities in Moncton quickly. Soon after, in press release dated November 23, 2016, OrganiGram announced, Trailer Park Boys Choose OrganiGram as Strategic Partner."34 However, in mid- December 2016, the Task Force on Cannabis Legalization and Regulation completed and released its report, which included many recommendations. For the purpose of minimizing the harm of use, the Task Force recommended that the federal government "apply comprehensive restrictions to the advertising and promotion of cannabis and related merchandise by any means, including sponsorship, endorsements and branding, similar to the restrictions on promotion of tobacco products.936 The Task Force also recommended that recreational products not be packaged in such a way that it would be appealing to children. With that in mind, what kinds of edibles would be permitted? The challenge was that OrganiGram was "deploying fairly substantive amounts of capital and not knowing exactly what the date is that that capital should be fully functioning, according to Rogers. Other LPs, such as Canopy Growth and Aurora Cannabis, were also preparing for the recreational market by developing strategic partnerships and raising capital to expand their operational capacities. On the medical side, the total number of patients who could legally purchase medical marijuana was limited by the number of physicians who were willing and able to prescribe cannabis. Many of the cannabis clinics were in Ontario and Western Canada, where most of the LPs were located. However, some clinics had satellite offices in Atlantic Canada. According to Rogers, many physicians were uncomfortable with prescribing cannabis to their patients and had to refer them to cannabis clinics. However, the market data found on Health Canada's website showed that the number of patients was increasing each quarter (see Exhibit 1). Even with these data and OrganiGram's enterprise resource planning systems, it was difficult to make forecasts because one did not know which companies the patients would choose. NEXT STEPS The largest players (including OrganiGram) in the medical cannabis industry were in the midst of expanding their operations in anticipation of the introduction of the Trudeau government's recreational cannabis legislation in the spring of 2017. In addition to its domestic expansion activities, Canopy Growth, the largest publicly traded cannabis company in Canada, was already engaging in several international expansion activities in Brazil, Germany, and Australia. However, Rogers said that there was a shortage of product in Canada at that point in time and OrganiGram did not have any immediate plans to export cannabis. Its focus was on the current medical cannabis market and the anticipated recreational market in Canada. From Rogers's perspective, it was unclear when the company could roll out new products, which products would be permitted, or who would be allowed to produce and/or sell recreational cannabis products. The challenge for OrganiGram was to work with the "grey knowledge while creating a strategy for the anticipated recreational cannabis market and working on its medical cannabis sales. What kind of strategy should Organigram have for the recreational cannabis market? How should it organize the company to market both medical and recreational cannabis? Would the legalization of recreational cannabis lead to regulations that allowed for imported cannabis? With so many variables still unknown, what kinds of scenarios should OrganiGram prepare to face? Was it possible to create an implementation plan with a timeline, roll out schedule, and initial steps that would take into account the different scenarios? EXHIBIT 1: MARKET DATA ON CANADA'S QUARTERLY SUPPLY OF CANNABIS FOR MEDICAL PURPOSES, APRIL 2015-SEPTEMBER 30, 2016 Apr. 1. July 1, Oct. 1, Jan. 1, Apr. 1, July 1, 2015- 2015 2015- 2016- 2016- 2016- June 30, Sep. 30, Dec. 31, Mar. 31, June 30, Sep. 30, 2015 (Q1) 2015 (Q2) 2015 (Q3) 2016 (24) 2016 (Q1) 2016 (Q2) Dried Marijuana 1,371 1,873 2,481 3,082 4,037 4,773 1,867 2,142 2,684 4,037 5,014 Amount sold to clients (in kg) Amount produced Amount in inventories of LPs at end of quarter 5,734 5,445 7,312 9,729 10,695 11,788 13,246 (in kg) Cannabis Oil N/A N/A 3 584 1,500 2,420 N/A 9 128 892 1,654 3,116 Amount sold to clients (in kg) Amount produced Amount in inventories of LPs at end of quarter N/A 7 208 1,421 2,038 3,330 (in kg) Client Data 3.3 3 2.9 2.8 2.7 2.6 Average amount authorized per client (g/day) Average amount per client shipment (g/day) Total number of registered clients at end of quarter 1.08 1.12 1.12 1.03 0.96 0.89 23,930 30,537 39,668 53,649 75,166 98,460 Note: Q = quarter; kg = kilogram; g = gram; LPs = licensed producers; N/A = not available Source: Government of Canada, "Market Data," accessed December 28, 2016, www.canada.ca/en/health- canada/services/drugs-health-products/medical-use-marijuana/licensed-producers/market-data.html