Question: those are two different questions they are fully complete and different, the first question was mistakly uploaded. Providing for Doubtful Accounts At the end of

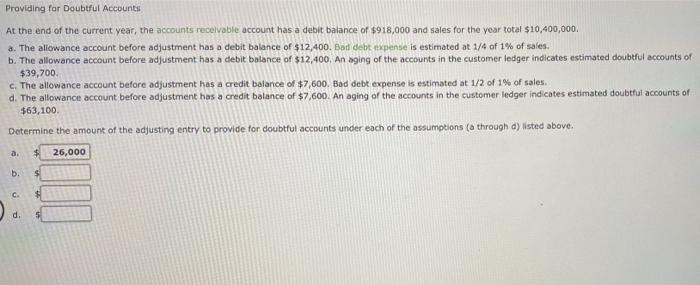

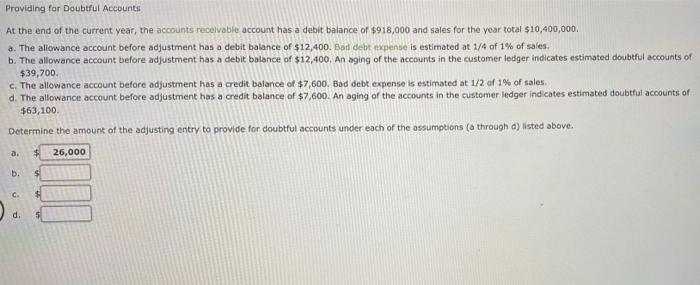

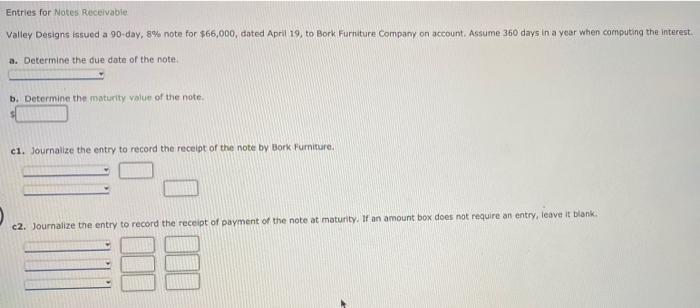

Providing for Doubtful Accounts At the end of the current year, the accounts receivable account has a debit balance of $918,000 and sales for the year total $10,400,000. a. The allowance account before adjustment has a debit balance of $12,400. Bad debt expense is estimated at 1/4 of 1% of sales. b. The allowance account before adjustment has a debit balance of $12,400. An aging of the accounts in the customer ledger indicates estimated doubtful accounts of $39,700. c. The allowance account before adjustment has a credit balance of $7,600. Bad debt expense is estimated at 1/2 of 1% of sales. d. The allowance account before adjustment has a credit balance of $7,600. An aging of the accounts in the customer ledger indicates estimated doubtful accounts of $63,100. Determine the amount of the adjusting entry to provide for doubtful accounts under each of the assumptions (a through d) listed above. a. 26,000 b. C. $ d. 5 Providing for Doubtful Accounts At the end of the current year, the accounts receivable account has a debit balance of $918,000 and sales for the year total $10,400,000. a. The allowance account before adjustment has a debit balance of $12,400. Bad debt expense is estimated at 1/4 of 1% of sales. b. The allowance account before adjustment has a debit balance of $12,400. An aging of the accounts in the customer ledger indicates estimated doubtful accounts of $39,700. c. The allowance account before adjustment has a credit balance of $7,600. Bad debt expense is estimated at 1/2 of 1% of sales. d. The allowance account before adjustment has a credit balance of $7,600. An aging of the accounts in the customer ledger indicates estimated doubtful accounts of $63,100. Determine the amount of the adjusting entry to provide for doubtful accounts under each of the assumptions (a through d) listed above. a. 26,000 b. C. $ d. 5 Entries for Notes Receivable Valley Designs issued a 90-day, 8% note for $66,000, dated April 19, to Bork Furniture Company on account. Assume 360 days in a year when computing the interest. a. Determine the due date of the note. b. Determine the maturity value of the note. c1. Journalize the entry to record the receipt of the note by Bork Furniture. c2. Journalize the entry to record the receipt of payment of the note at maturity. If an amount box does not require an entry, leave it blank

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts