Question: Three alternatives are being considered A: Machine A can be purchased for 10,000. It generates 4000 per year and can be sold for 1,000 after

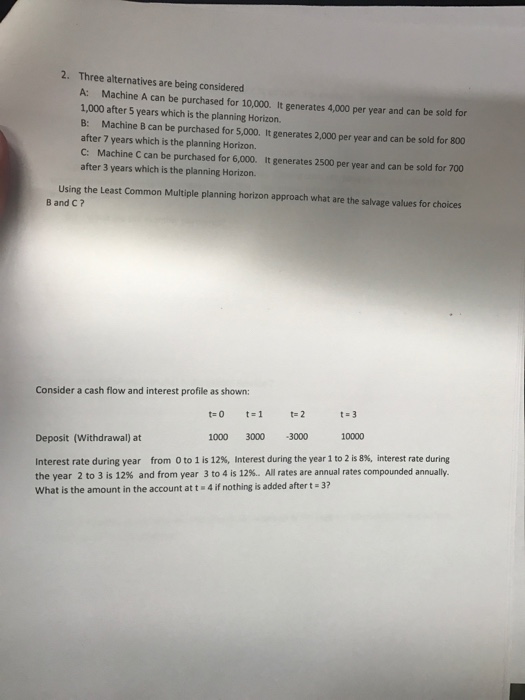

Three alternatives are being considered A: Machine A can be purchased for 10,000. It generates 4000 per year and can be sold for 1,000 after 5 years which is the planning Horizon. B: Machine B can be purchased for 5,000. It generates 2,000 per year and can be sold for 800 after 7 years which is the planning Horizon. C: Machine C can be purchased for 6,000. It generates 2500 per year and can be sold for 700 after 3 years which is the planning Horizon. Using the Least Common Multiple planning horizon approach what are the salvage values for choices Band C? Consider a cash flow and interest profile as shown: Deposit (Withdrawal) at Interest rate during year from 0 to 1 is 12%, Interest during the year 1 to 2 is 8%, interest rate during the year 2 to 3 is 12% and from year 3 to 4 is 12%. A rates are annual rates compounded annually. What is the amount in the account at t = 4 if nothing is added after 3

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts