Question: Three alternatives are being considered for an engineering project. Their cash-flow estimates are shown in the accompanying table. A and B are mutually exclusive, and

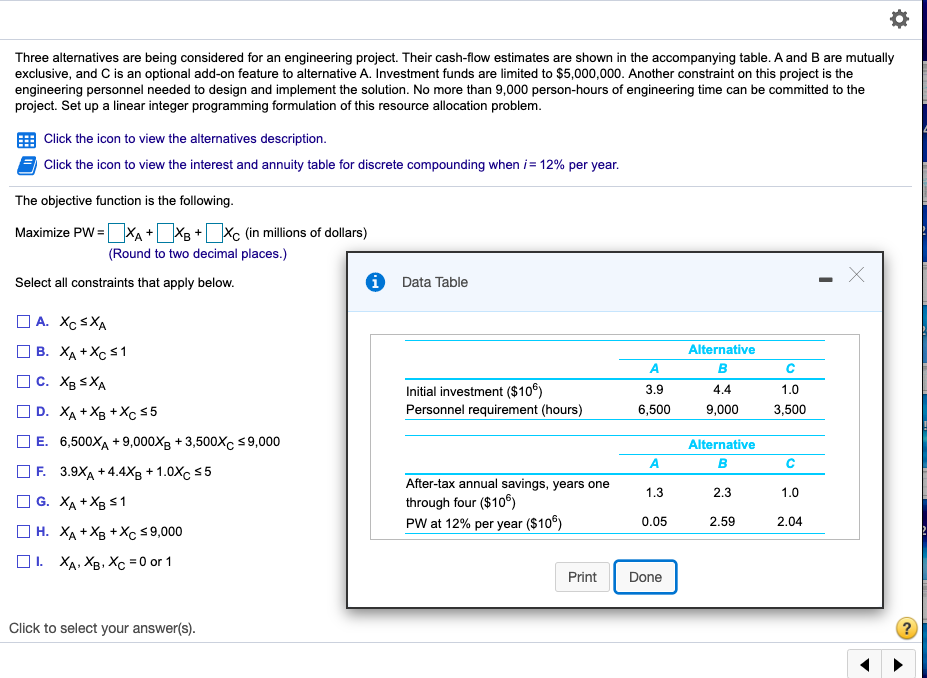

Three alternatives are being considered for an engineering project. Their cash-flow estimates are shown in the accompanying table. A and B are mutually exclusive, and C is an optional add-on feature to alternative A. Investment funds are limited to $5,000,000. Another constraint on this project is the engineering personnel needed to design and implement the solution. No more than 9,000 person-hours of engineering time can be committed to the project. Set up a linear integer programming formulation of this resource allocation problem. Click the icon to view the alternatives description. Click the icon to view the interest and annuity table for discrete compounding when i = 12% per year. The objective function is the following. Maximize PW= XA+ X8+ *c (in millions of dollars) (Round to two decimal places.) Select all constraints that apply below. i Data Table Alternative B 4.4 9,000 3.9 6,500 Initial investment ($106) Personnel requirement (hours) C 1.0 3,500 A. Xc SXA DB. XA +Xc = 1 c. Xg SXA OD. XA + XB + Xc 55 E. 6,500XA +9,000X8 +3,500Xc 59,000 F. 3.9XA +4.488 +1.0XC 55 G. XA + X3 51 DH. XA +XB +8c 39,000 OL. XA, XB, Xc = 0 or 1 Alternative - AB After-tax annual savings, years one through four ($106) PW at 12% per year ($106) 1.3 1 0.05 2.3 2.59 1.0 .04 2 Print Done Click to select your answer(s)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts