Question: Three Beans is a cafe located in Glebe, Sydney, and is registered for GST. The financial statement for the quarter ended April 2022 shows the

Three Beans is a cafe located in Glebe, Sydney, and is registered for GST. The financial statement for the quarter ended April 2022 shows the following: Price includes insurance and transport costs Required: Calculate GST payable/refundable for the April quarter. Your answer must be supported by reference to legislation, caselaw and rulings (if any).

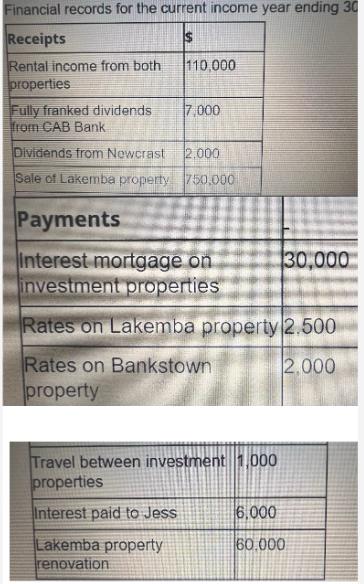

Financial records for the current income year ending 30 $ Receipts Rental income from both; properties 110,000 Fully franked dividends from CAB Bank Dividends from Newcrast 2.000 Sale of Lakemba property 750,000 7,000 Payments Interest mortgage on investment properties 30,000 Rates on Lakemba property 2.500 Rates on Bankstown 2.000 property Travel between investment 1,000 properties Interest paid to Jess Lakemba property renovation 6,000 60.000

Step by Step Solution

3.44 Rating (154 Votes )

There are 3 Steps involved in it

Determine Taxable Supplies Sales Rental income from both properties 110000 Sale of Lakemba ... View full answer

Get step-by-step solutions from verified subject matter experts