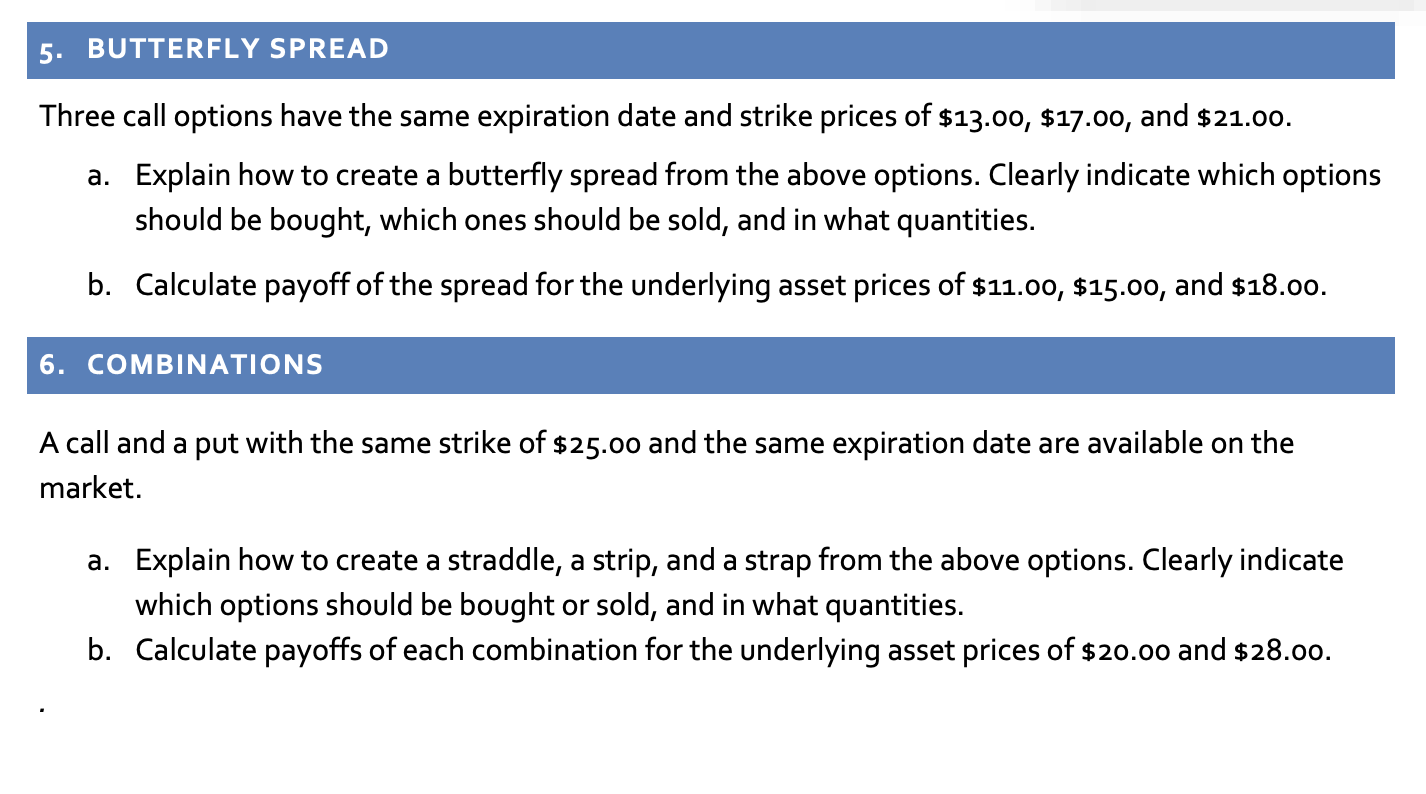

Question: Three call options have the same expiration date and strike prices of $13.00,$17.00, and $21.00. a. Explain how to create a butterfly spread from the

Three call options have the same expiration date and strike prices of $13.00,$17.00, and $21.00. a. Explain how to create a butterfly spread from the above options. Clearly indicate which options should be bought, which ones should be sold, and in what quantities. b. Calculate payoff of the spread for the underlying asset prices of $11.00,$15.00, and $18.00. 6. COMBINATIONS A call and a put with the same strike of $25.00 and the same expiration date are available on the market. a. Explain how to create a straddle, a strip, and a strap from the above options. Clearly indicate which options should be bought or sold, and in what quantities. b. Calculate payoffs of each combination for the underlying asset prices of $20.00 and $28.00

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts