Question: Three call options on a stock have the same expiration date and strike prices of 55,60,65. The market prices are $8, $5, and $3, respectively.

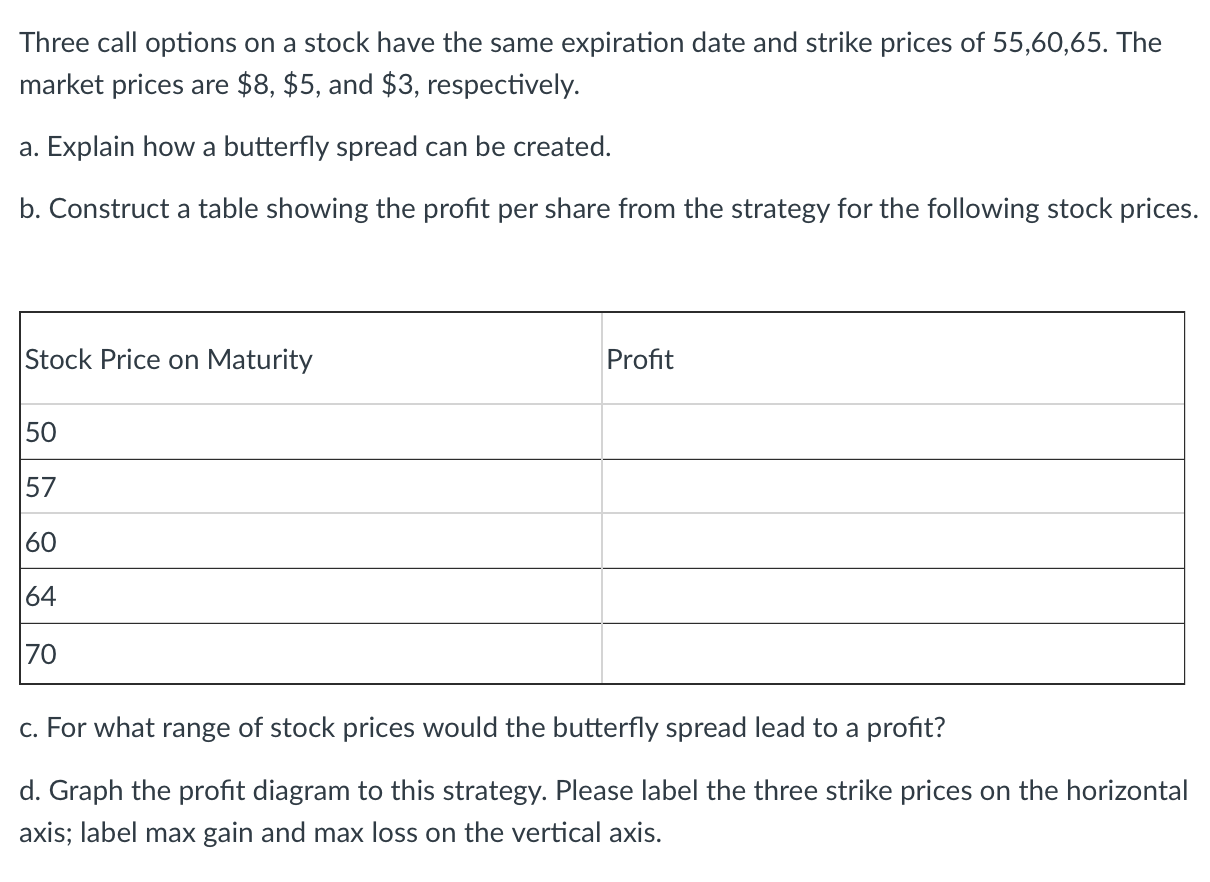

Three call options on a stock have the same expiration date and strike prices of 55,60,65. The market prices are $8, $5, and $3, respectively. a. Explain how a butterfly spread can be created. b. Construct a table showing the profit per share from the strategy for the following stock prices. Stock Price on Maturity Profit 50 57 60 64 70 c. For what range of stock prices would the butterfly spread lead to a profit? d. Graph the profit diagram to this strategy. Please label the three strike prices on the horizontal axis; label max gain and max loss on the vertical axis

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock