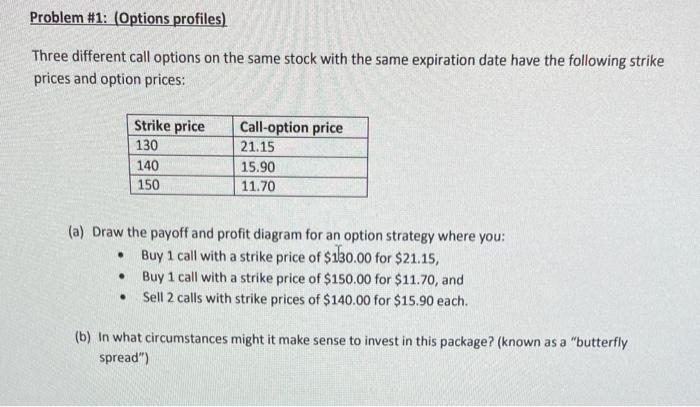

Question: Three different call options on the same stock with the same expiration date have the following strike prices and option prices: (a) Draw the payoff

Three different call options on the same stock with the same expiration date have the following strike prices and option prices: (a) Draw the payoff and profit diagram for an option strategy where you: - Buy 1 call with a strike price of $130.00 for $21.15, - Buy 1 call with a strike price of $150.00 for $11.70, and - Sell 2 calls with strike prices of $140.00 for $15.90 each. (b) In what circumstances might it make sense to invest in this package? (known as a "butterfly spread")

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts