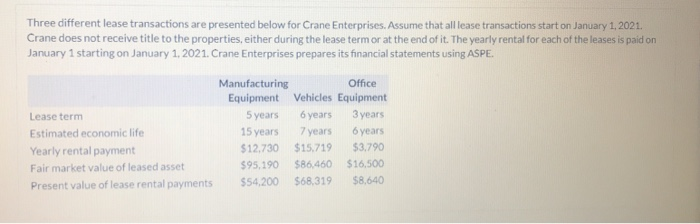

Question: Three different lease transactions are presented below for Crane Enterprises. Assume that all lease transactions start on January 1, 2021. Crane does not receive title

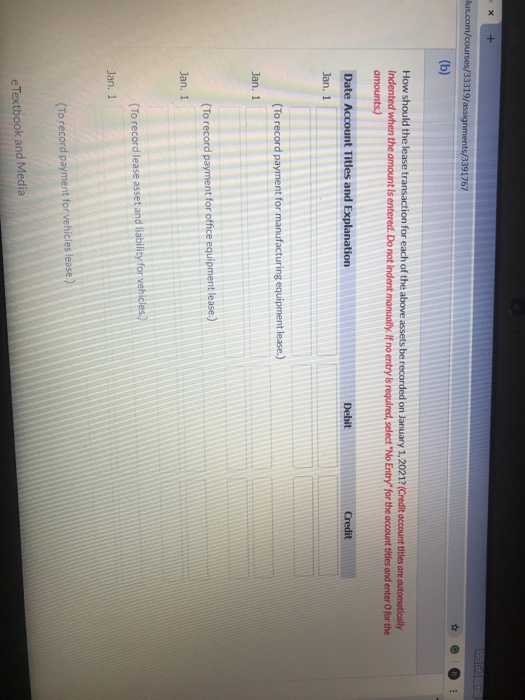

Three different lease transactions are presented below for Crane Enterprises. Assume that all lease transactions start on January 1, 2021. Crane does not receive title to the properties, either during the lease term or at the end of it. The yearly rental for each of the leases is paid on January 1 starting on January 1, 2021. Crane Enterprises prepares its financial statements using ASPE Manufacturing Office Equipment Vehicles Equipment Lease term 5 years 6 years 3 years Estimated economic life 15 years 7 years 6 years Yearly rental payment $12,730 $15.719 $3.790 Fair market value of leased asset $95,190 $86,460 $16,500 Present value of lease rental payments $54,200 $68,319 $8,640 Hlus.com/courses/33319/assignments/3391767 (b) How should the lease transaction for each of the above assets be recorded on January 1, 2021? (Credit account Utles are automatically Indented when the amount is entered. Do not Indent manually. If no entry is required, select "No Entry for the account titles and enter for the amounts.) Date Account Titles and Explanation Debit Credit Jan. 1 (To record payment for manufacturing equipment lease.) Jan. 1 (To record payment for office equipment lease.) Jan. 1 (To record lease asset and liability for vehicles.) Jan. 1 (To record payment for vehicles lease.) e Textbook and Media

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts