Question: Three different plans for financing an $18,000,000 corporation are under consideration by its organizers. Under each of the following plans, the securities will be issued

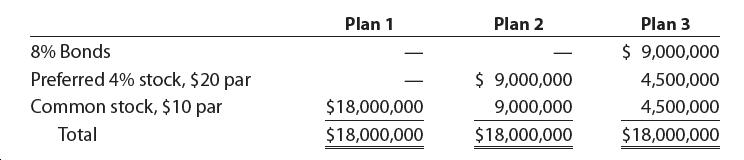

Three different plans for financing an $18,000,000 corporation are under consideration by its organizers. Under each of the following plans, the securities will be issued at their par or face amount, and the income tax rate is estimated at 40% of income:

Please see the attachment for details:

Instructions

1. Determine the earnings per share of common stock for each plan, assuming that the income before bond interest and income tax is $2,100,000.

2. Determine the earnings per share of common stock for each plan, assuming that the income before bond interest and income tax is $1,050,000.

3. Discuss the advantages and disadvantages of each plan.

Plan 1 Plan 2 Plan 3 8% Bonds $ 9,000,000 $ 9,000,000 Preferred 4% stock, $20 par Common stock, $10 par 4,500,000 $18,000,000 9,000,000 4,500,000 Total $18,000,000 $18,000,000 $18,000,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts