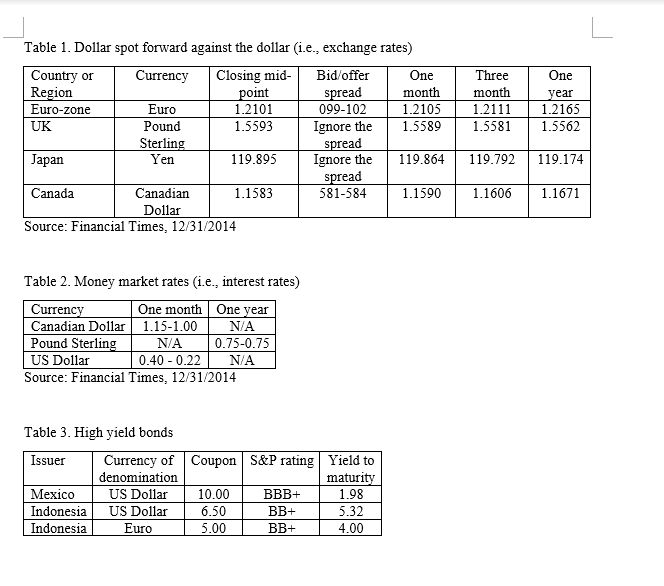

Question: Three month 1.2111 1.5581 One year 1.2165 1.5562 Table 1. Dollar spot forward against the dollar (i.e., exchange rates) Country or Currency Closing mid- Bid

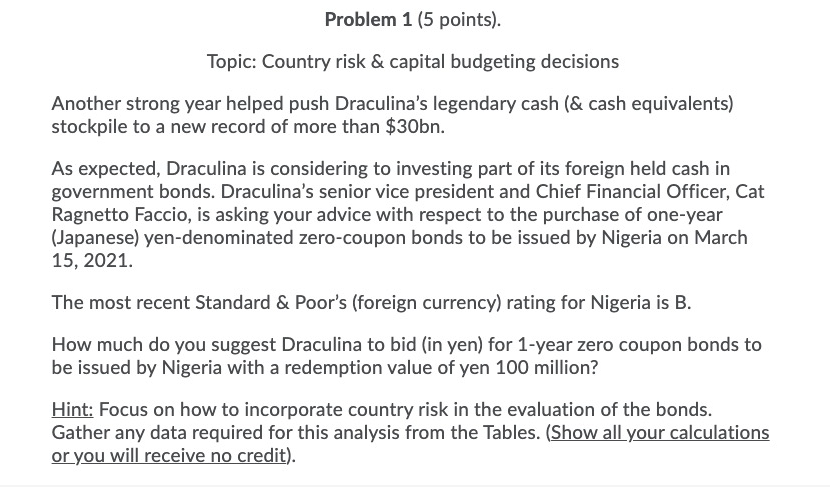

Three month 1.2111 1.5581 One year 1.2165 1.5562 Table 1. Dollar spot forward against the dollar (i.e., exchange rates) Country or Currency Closing mid- Bid offer One Region point spread month Euro-zone Euro 1.2101 099-102 1.2105 UK Pound 1.5593 Ignore the 1.5589 Sterling spread Japan Yen 119.895 Ignore the 119.864 spread Canada Canadian 1.1583 581-584 1.1590 Dollar Source: Financial Times, 12/31/2014 119.792 119.174 1.1606 1.1671 Table 2. Money market rates (1.e., interest rates) Currency One month One year Canadian Dollar 1.15-1.00 N/A Pound Sterling N/A 0.75-0.75 US Dollar 0.40 -0.22 N/A Source: Financial Times, 12/31/2014 Table 3. High yield bonds Issuer Currency of Coupon S&P rating Yield to denomination maturity Mexico US Dollar 10.00 BBB+ 1.98 Indonesia US Dollar 6.50 BB+ 5.32 Indonesia Euro 5.00 BB+ 4.00 Problem 1 (5 points). Topic: Country risk & capital budgeting decisions Another strong year helped push Draculina's legendary cash (& cash equivalents) stockpile to a new record of more than $30bn. As expected, Draculina is considering to investing part of its foreign held cash in government bonds. Draculina's senior vice president and Chief Financial Officer, Cat Ragnetto Faccio, is asking your advice with respect to the purchase of one-year (Japanese) yen-denominated zero-coupon bonds to be issued by Nigeria on March 15, 2021. The most recent Standard & Poor's (foreign currency) rating for Nigeria is B. How much do you suggest Draculina to bid (in yen) for 1-year zero coupon bonds to be issued by Nigeria with a redemption value of yen 100 million? Hint: Focus on how to incorporate country risk in the evaluation of the bonds. Gather any data required for this analysis from the Tables. (Show all your calculations or you will receive no credit). Three month 1.2111 1.5581 One year 1.2165 1.5562 Table 1. Dollar spot forward against the dollar (i.e., exchange rates) Country or Currency Closing mid- Bid offer One Region point spread month Euro-zone Euro 1.2101 099-102 1.2105 UK Pound 1.5593 Ignore the 1.5589 Sterling spread Japan Yen 119.895 Ignore the 119.864 spread Canada Canadian 1.1583 581-584 1.1590 Dollar Source: Financial Times, 12/31/2014 119.792 119.174 1.1606 1.1671 Table 2. Money market rates (1.e., interest rates) Currency One month One year Canadian Dollar 1.15-1.00 N/A Pound Sterling N/A 0.75-0.75 US Dollar 0.40 -0.22 N/A Source: Financial Times, 12/31/2014 Table 3. High yield bonds Issuer Currency of Coupon S&P rating Yield to denomination maturity Mexico US Dollar 10.00 BBB+ 1.98 Indonesia US Dollar 6.50 BB+ 5.32 Indonesia Euro 5.00 BB+ 4.00 Problem 1 (5 points). Topic: Country risk & capital budgeting decisions Another strong year helped push Draculina's legendary cash (& cash equivalents) stockpile to a new record of more than $30bn. As expected, Draculina is considering to investing part of its foreign held cash in government bonds. Draculina's senior vice president and Chief Financial Officer, Cat Ragnetto Faccio, is asking your advice with respect to the purchase of one-year (Japanese) yen-denominated zero-coupon bonds to be issued by Nigeria on March 15, 2021. The most recent Standard & Poor's (foreign currency) rating for Nigeria is B. How much do you suggest Draculina to bid (in yen) for 1-year zero coupon bonds to be issued by Nigeria with a redemption value of yen 100 million? Hint: Focus on how to incorporate country risk in the evaluation of the bonds. Gather any data required for this analysis from the Tables. (Show all your calculations or you will receive no credit)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts