Question: Three mutually exclusive design alternatives are being considered. The estimated sales and cost data for each alternative are given on p. 292. The MARR is

Three mutually exclusive design alternatives are being considered. The estimated sales and cost data for each alternative are given on p. 292. The MARR is 20% per year. Annual revenues are based on the number of units sold and the selling price. Annual expenses are based on fixed and variable costs. Determine which selection is preferable based on AW. State your assumptions.

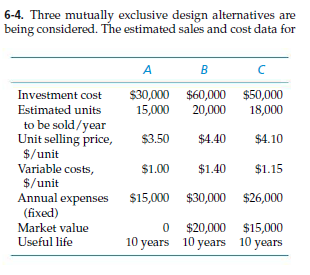

6-4. Three mutually exclusive design alternatives are being considered. The estimated sales and cost data for Investment cost$30,000 $60,000 $50,000 Estimated units 15,000 20,000 18,000 to be sold/year Unit selling price, 3.50 $4.40 $4.10 $/unit Variable costs, $/unit $1.00 $1.40 $1.15 Annual expenses $15,000 $30,000 $26,000 0 $20,000 $15,000 (fixed) Market value Useful life 10 years 10 years 10 years

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts