Question: Three mutually exclusive investment alternative for implementing an office automation plan in an engineering design firm are being considered. Each alternative meets the same service

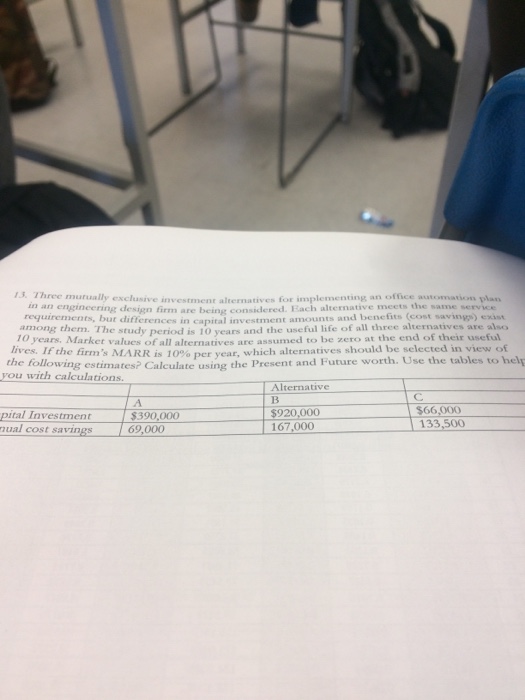

Three mutually exclusive investment alternative for implementing an office automation plan in an engineering design firm are being considered. Each alternative meets the same service requirements, but differences in capital investment amounts and benefits (cost savings) exist among them. The study period is 10 years and the useful life of all three alternatives are also 10 years. Market values of all alternatives are assumed to be zero at the end of their useful lives. If the firm's MARR is 10% per year, which alternatives should be selected in view of the following estimates? Calculate using the Present and Future worth. Use the tables to help you with calculations

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts