Question: Three mutually exclusive projects, Project A, Project B, and Project C, are being considered for investment at a MARR of 10%. The three investments

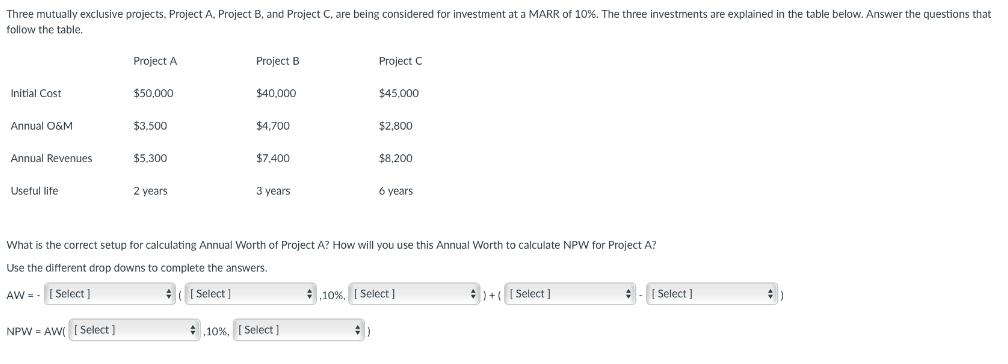

Three mutually exclusive projects, Project A, Project B, and Project C, are being considered for investment at a MARR of 10%. The three investments are explained in the table below. Answer the questions that follow the table. Initial Cost Annual O&M Annual Revenues Useful life Project A NPW AW [Select] $50,000 $3,500 $5,300 2 years Project B $40,000 $4,700 $7,400 3 years Project C 10%, [Select] $45,000 $2,800 $8,200 What is the correct setup for calculating Annual Worth of Project A? How will you use this Annual Worth to calculate NPW for Project A? Use the different drop downs to complete the answers. AW=- [Select] ([Select] 6 years # 10%, [Select] +)+([Select] + [Select] #)

Step by Step Solution

3.37 Rating (144 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts