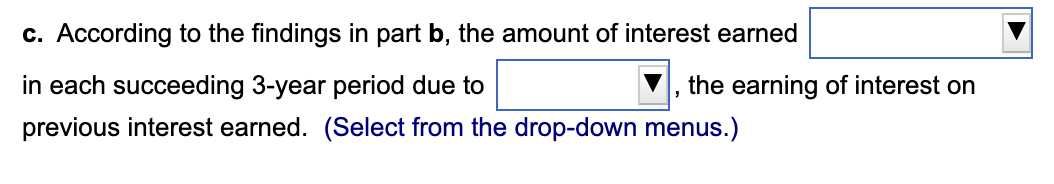

Question: three options of problem c. for choose first. -increases, -decreases, -remains the same second. -compounding, -future value, -present value Time value Personal Finance Problem You

three options of problem c. for choose

first. -increases, -decreases, -remains the same

second. -compounding, -future value, -present value

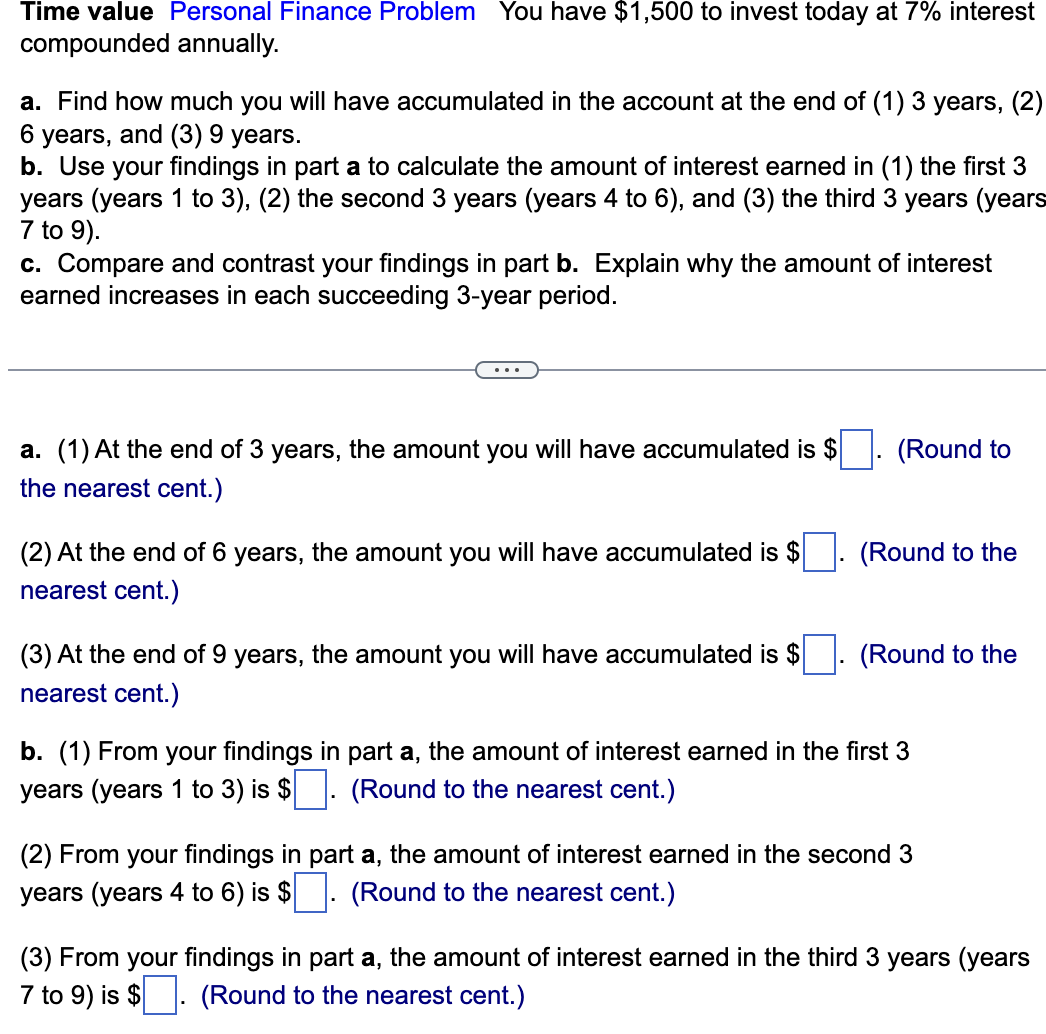

Time value Personal Finance Problem You have $1,500 to invest today at 7% interest compounded annually. a. Find how much you will have accumulated in the account at the end of (1) 3 years, (2) 6 years, and (3) 9 years. b. Use your findings in part a to calculate the amount of interest earned in (1) the first 3 years (years 1 to 3 ), (2) the second 3 years (years 4 to 6), and (3) the third 3 years (years 7 to 9) c. Compare and contrast your findings in part b. Explain why the amount of interest earned increases in each succeeding 3 -year period. a. (1) At the end of 3 years, the amount you will have accumulated is $ the nearest cent.) (Round to (Round to the (2) At the end of 6 years, the amount you will have accumulated is $ nearest cent.) (3) At the end of 9 years, the amount you will have accumulated is $ (Round to the nearest cent.) b. (1) From your findings in part a, the amount of interest earned in the first 3 years (years 1 to 3 ) is $. (Round to the nearest cent.) (2) From your findings in part a, the amount of interest earned in the second 3 years (years 4 to 6 ) is $. (Round to the nearest cent.) (3) From your findings in part a, the amount of interest earned in the third 3 years (years 7 to 9 ) is $ . (Round to the nearest cent.) c. According to the findings in part b, the amount of interest earned in each succeeding 3-year period due to , the earning of interest on previous interest earned. (Select from the drop-down menus.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts