Question: Three problems below: write and submit file. Problem A: If you were to buy a home for $178,500 i= 3% ; n=30 years. Assume you

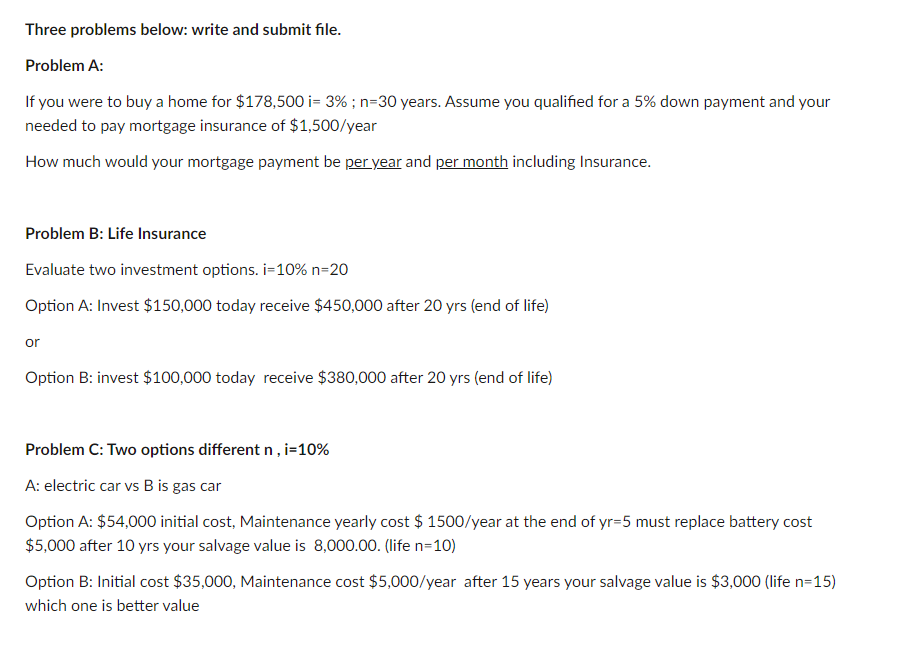

Three problems below: write and submit file. Problem A: If you were to buy a home for $178,500 i= 3% ; n=30 years. Assume you qualified for a 5% down payment and your needed to pay mortgage insurance of $1,500/year How much would your mortgage payment be per year and per month including Insurance. Problem B: Life Insurance Evaluate two investment options. i=10% n=20 Option A: Invest $150,000 today receive $450,000 after 20 yrs (end of life) or Option B: invest $100,000 today receive $380,000 after 20 yrs (end of life) Problem C: Two options different n, i=10% A: electric car vs B is gas car Option A: $54,000 initial cost, Maintenance yearly cost $ 1500/year at the end of yr=5 must replace battery cost $5,000 after 10 yrs your salvage value is 8,000.00. (life n=10) Option B: Initial cost $35,000, Maintenance cost $5,000/year after 15 years your salvage value is $3,000 (life n=15) which one is better value

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts