Question: Three programmers at Feentx Computer Storage, Incorporated, wite an operating systems control manual for Hill - McGraw Publishing, Incorporated, for which Feentx recelves royaltses equal

Three programmers at Feentx Computer Storage, Incorporated, wite an operating systems control manual for HillMcGraw Publishing, Incorporated, for which Feentx recelves royaltses equal to of net sales. Royalties are payable annually on February for sales the previous year. The editor indicated to Feentx on December that book sales subject to royalties for the year just ended are expected to be $ Accordingly. Feenbx accrued royalty revenue of $ at December and recelved royalties of $ on February

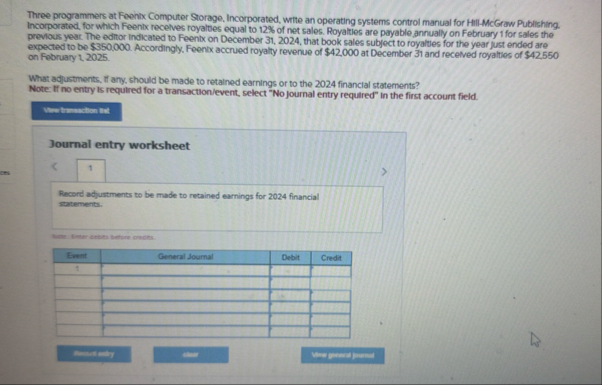

What adfustments. If any, should be made to retained earnings or to the financial statements?

Note: If no entry is required for a transactionevent select No journal entry required" in the first account field.

Journal entry worksheet

Record adjustments to be made to retained earnings for financial statements.

After eebes biftore crects.

tableEnentCheneral Journal,Debit,Credit

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock