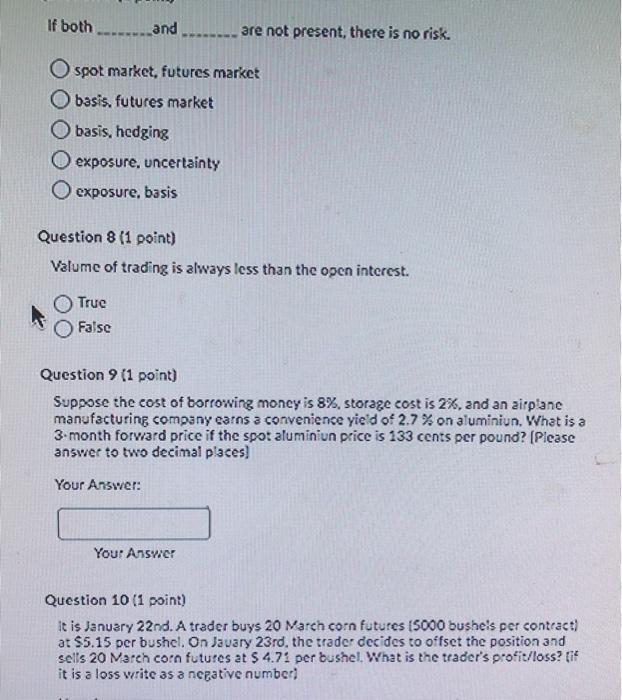

Question: three questions please If both ....... and ... are not present, there is no risk. O spot market, futures market O basis, futures market O

three questions please

three questions please If both ....... and ... are not present, there is no risk. O spot market, futures market O basis, futures market O basis, hedging O exposure, uncertainty O exposure, basis Question 8 (1 point) Valume of trading is always less than the open interest. Truc False Question 9 (1 point) Suppose the cost of borrowing money is 8%, storage cost is 2%, and an airplane manufacturing company earns a convenience yield of 2.7% on aluminiun, What is a 3-month forward price if the spot aluminiun price is 133 cents per pound? (Please answer to two decimal places) Your Answer: Your Answer Question 10 (1 point) it is January 22nd. A trader buys 20 March corn futures (5000 bushe's per contract) at $5.15 per bushcl. On Jauary 23rd, the trader decides to offset the position and sells 20 March corn futures at $ 4.7. per bushel. What is the trader's profit/loss? it is a loss write as a negative number)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts