Question: Three years ago, Nick joined the NR Partnership by contributing land with a $14,000 basis and a $19,000 FMV. On January 15 of the

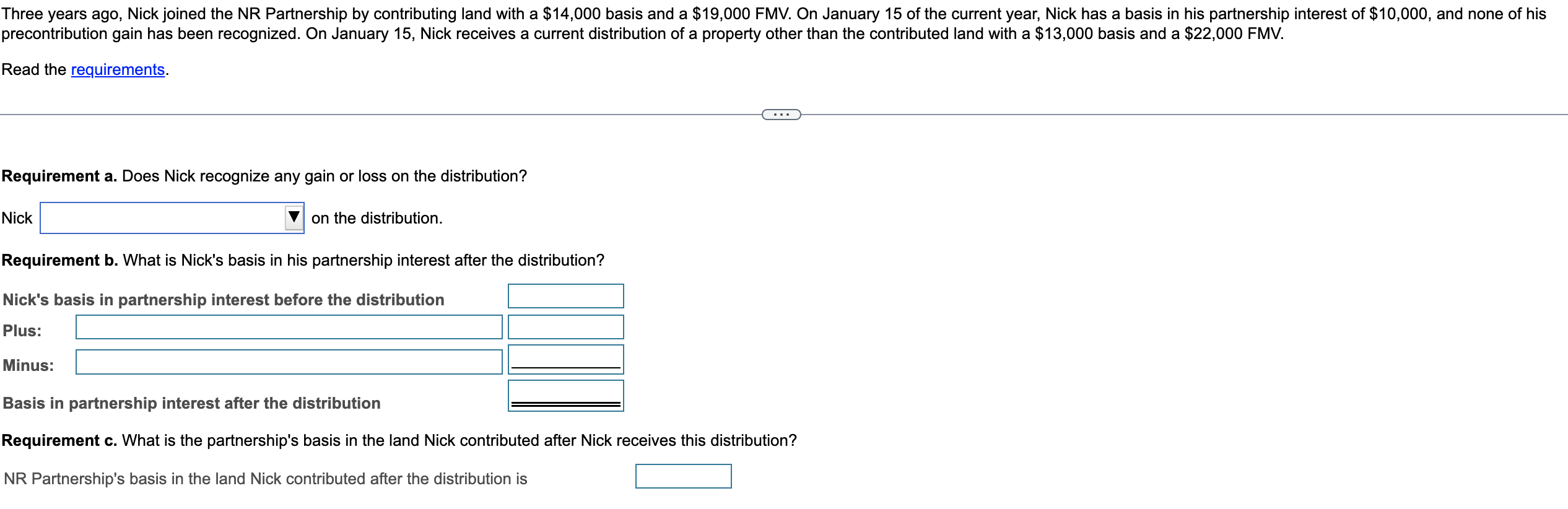

Three years ago, Nick joined the NR Partnership by contributing land with a $14,000 basis and a $19,000 FMV. On January 15 of the current year, Nick has a basis in his partnership interest of $10,000, and none of his precontribution gain has been recognized. On January 15, Nick receives a current distribution of a property other than the contributed land with a $13,000 basis and a $22,000 FMV. Read the requirements. Requirement a. Does Nick recognize any gain or loss on the distribution? Nick on the distribution. Requirement b. What is Nick's basis in his partnership interest after the distribution? Nick's basis in partnership interest before the distribution Plus: Minus: Basis in partnership interest after the distribution Requirement c. What is the partnership's basis in the land Nick contributed after Nick receives this distribution? NR Partnership's basis in the land Nick contributed after the distribution is

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts