Question: Thumbs up for correct answer (Capital structure weights) Wingate Metal Products, Inc. sells materials to contractors who construct metal warehouses, storage buildings, and other structures.

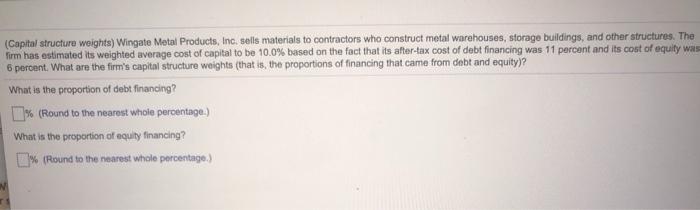

(Capital structure weights) Wingate Metal Products, Inc. sells materials to contractors who construct metal warehouses, storage buildings, and other structures. The firm has estimated its weighted average cost of capital to be 10.0% based on the fact that its after-tax cost of debt financing was 11 percent and its cost of equity was 6 peront. What are the firm's capital structure weights (that is, the proportions of financing that came from debt and equity)? What is the proportion of debt financing? I% (Round to the nearest whole percentage.) What is the proportion of equity financing? [% (Round to the nearest whole percentage.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts