Question: thumbs up for help Parker Inc. is using the LIFO method, what is the cost of goods sold? Units Unit Cost Total Cost Beginning Inventory

thumbs up for help

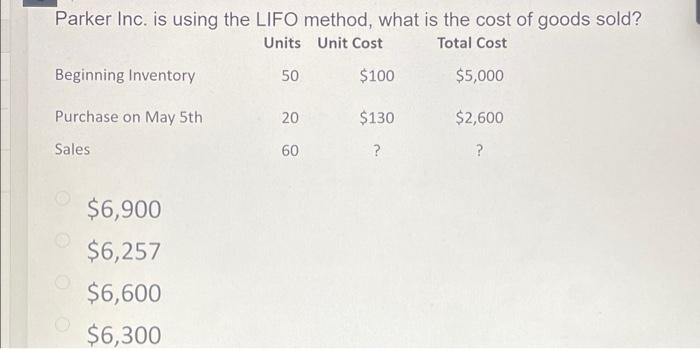

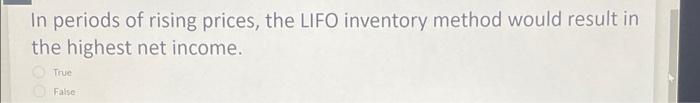

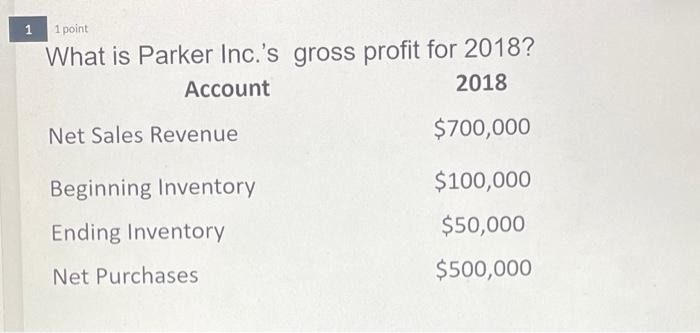

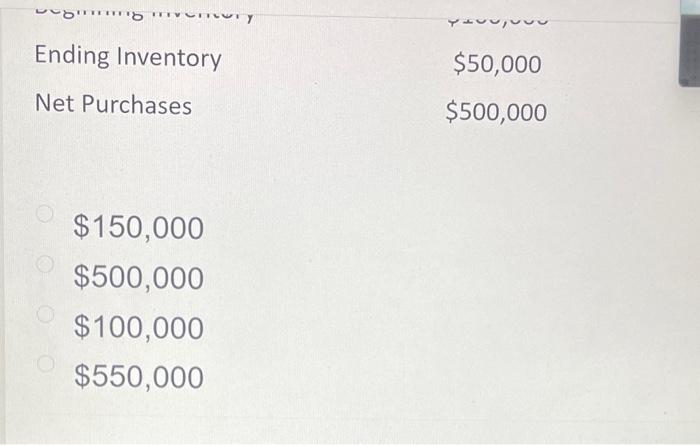

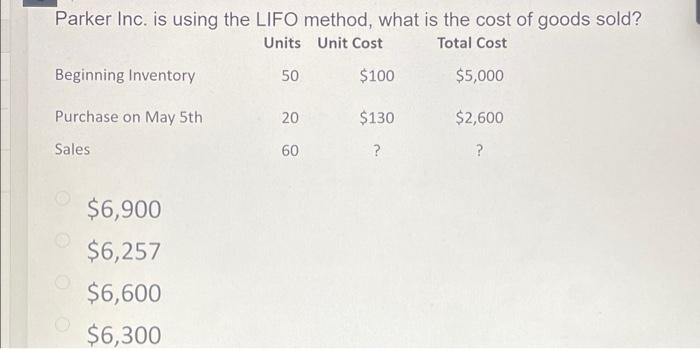

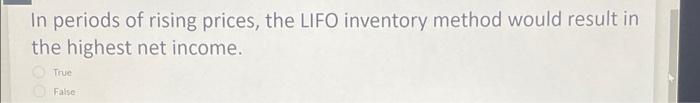

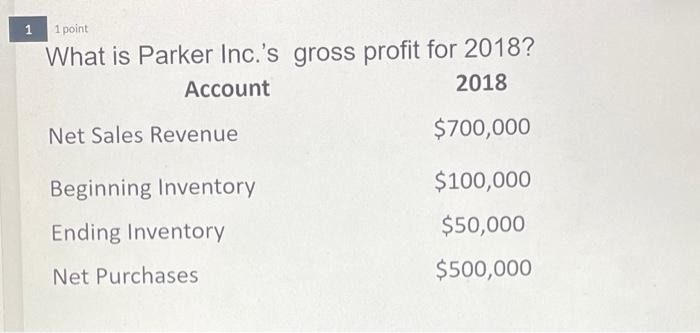

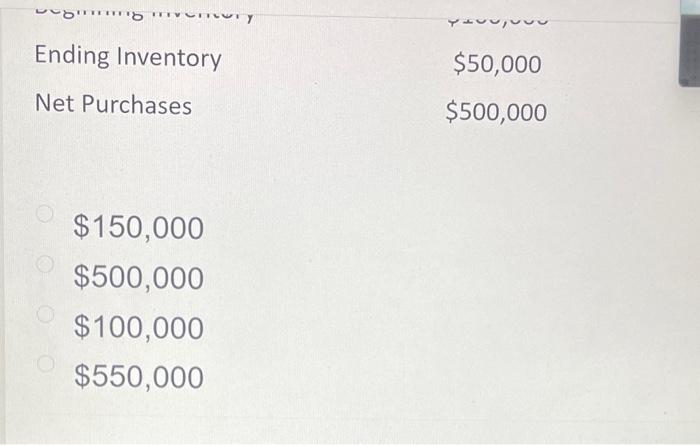

Parker Inc. is using the LIFO method, what is the cost of goods sold? Units Unit Cost Total Cost Beginning Inventory 50 $5,000 Purchase on May 5th 20 $2,600 Sales 60 ? $6,900 $6,257 $6,600 $6,300 $100 $130 ? In periods of rising prices, the LIFO inventory method would result in the highest net income. True False H 1 point What is Parker Inc.'s gross profit for 2018? Account 2018 Net Sales Revenue $700,000 Beginning Inventory $100,000 Ending Inventory $50,000 Net Purchases $500,000 mver WTY Ending Inventory Net Purchases $150,000 $500,000 $100,000 $550,000 $50,000 $500,000

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock