Question: thumbs up upon completion. i need this answer in 30 min please and thanks Square Hammer Corporation shows the following information its 2018 income statement:

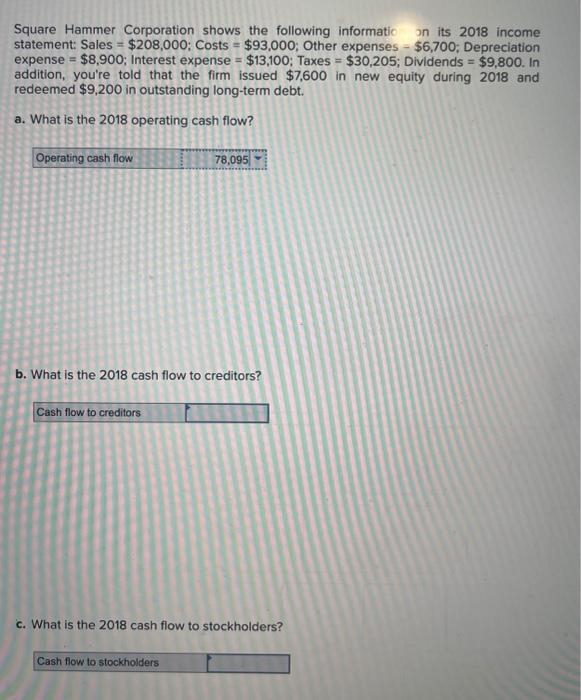

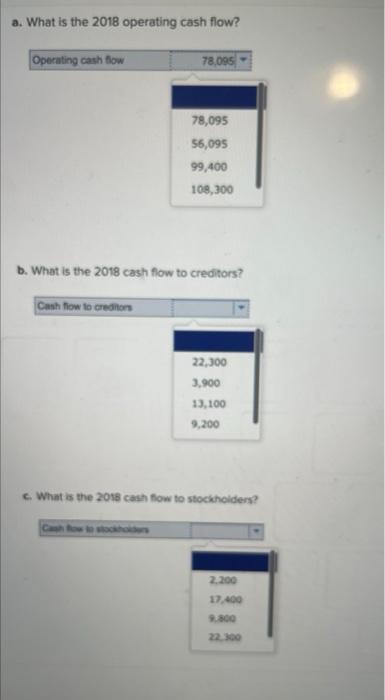

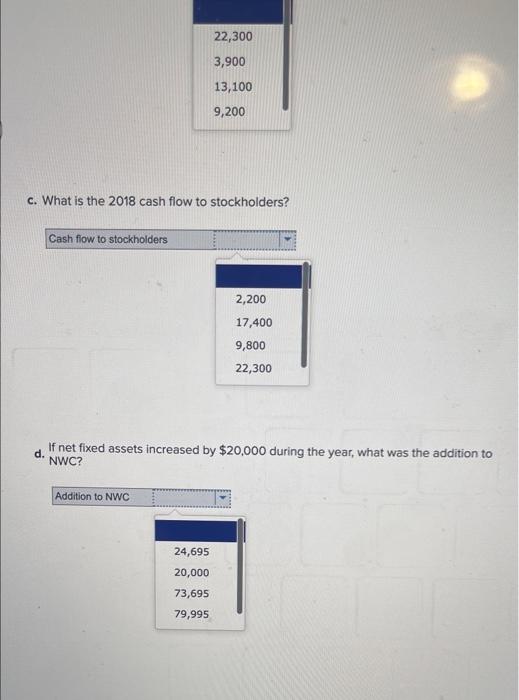

Square Hammer Corporation shows the following information its 2018 income statement: Sales = $208,000: Costs = $93,000; Other expenses - $6,700; Depreciation expense = $8,900; Interest expense = $13,100; Taxes = $30,205; Dividends = $9,800. In addition, you're told that the firm issued $7,600 in new equity during 2018 and redeemed $9,200 in outstanding long-term debt. a. What is the 2018 operating cash flow? Operating cash flow 78,095 b. What is the 2018 cash flow to creditors? Cash flow to creditors c. What is the 2018 cash flow to stockholders? Cash flow to stockholders a. What is the 2018 operating cash flow? Operating cash flow 78,095 78,095 55,095 99,400 108,300 D. What is the 2018 cash flow to creditors? Cash flow to creditors 22,300 3.900 13.100 9.200 c. What is the 2018 cash flow to stockholders? 2.200 17.400 2.800 22 300 22,300 3,900 13,100 9,200 c. What is the 2018 cash flow to stockholders? Cash flow to stockholders 2,200 17,400 9,800 22,300 d. If net fixed assets increased by $20,000 during the year, what was the addition to NWC? Addition to NWC 24,695 20,000 73,695 79,995

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts