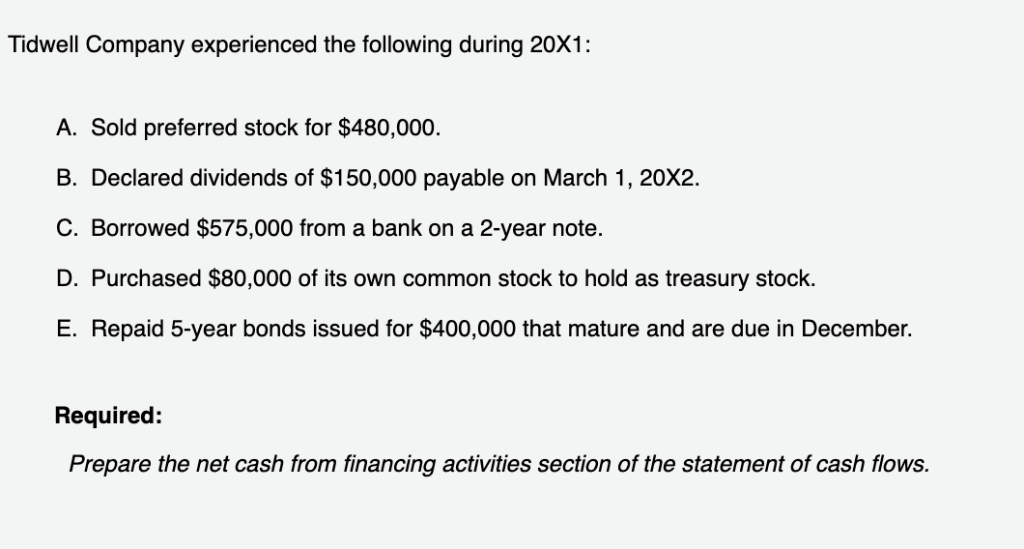

Question: Tidwell Company experienced the following during 20X1: A. Sold preferred stock for $480,000. B. Declared dividends of $150,000 payable on March 1, 20X2 C. Borrowed

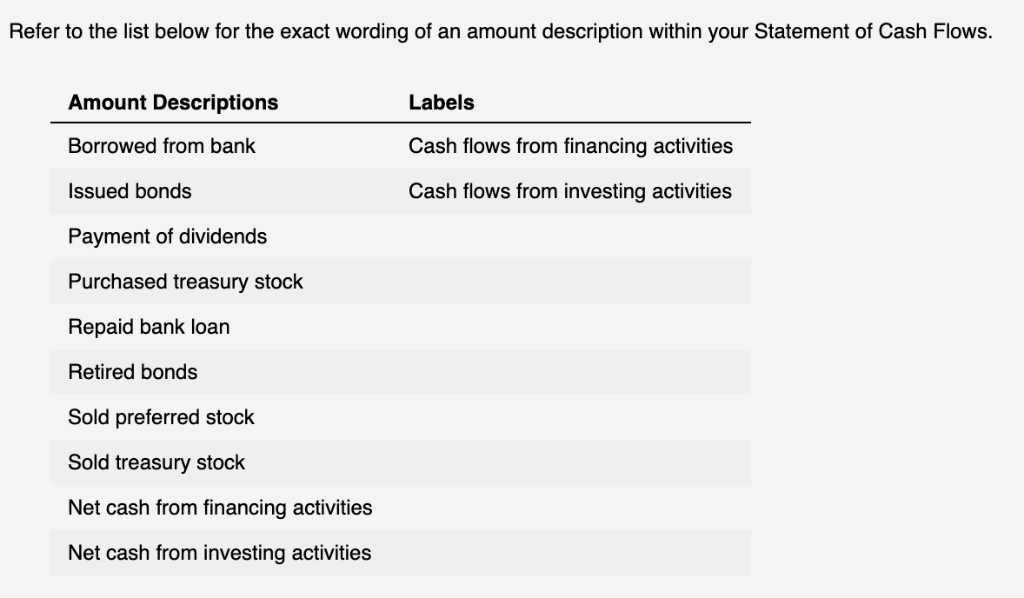

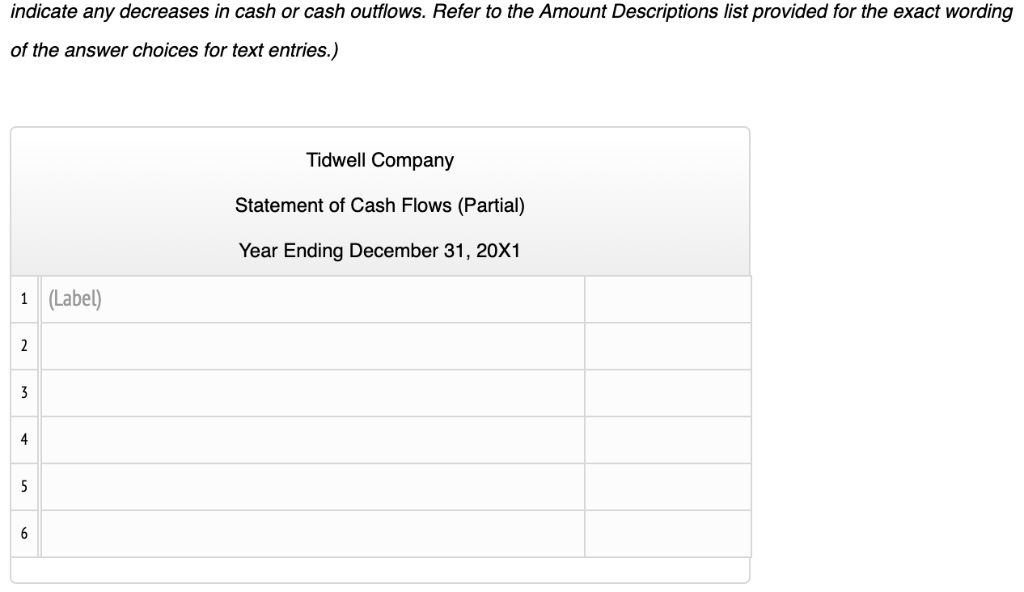

Tidwell Company experienced the following during 20X1: A. Sold preferred stock for $480,000. B. Declared dividends of $150,000 payable on March 1, 20X2 C. Borrowed $575,000 from a bank on a 2-year note. D. Purchased $80,000 of its own common stock to hold as treasury stock. E. Repaid 5-year bonds issued for $400,000 that mature and are due in December. Required: Prepare the net cash from financing activities section of the statement of cash flows. Refer to the list below for the exact wording of an amount description within your Statement of Cash Flows. Amount Descriptions Borrowed from bank Issued bonds Payment of dividends Purchased treasury stock Repaid bank loan Retired bonds Sold preferred stock Sold treasury stock Net cash from financing activities Net cash from investing activities Labels Cash flows from financing activities Cash flows from investing activities indicate any decreases in cash or cash outflows. Refer to the Amount Descriptions list provided for the exact wording of the answer choices for text entries.) Tidwell Company Statement of Cash Flows (Partial) Year Ending December 31, 20X1 1(Label)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts