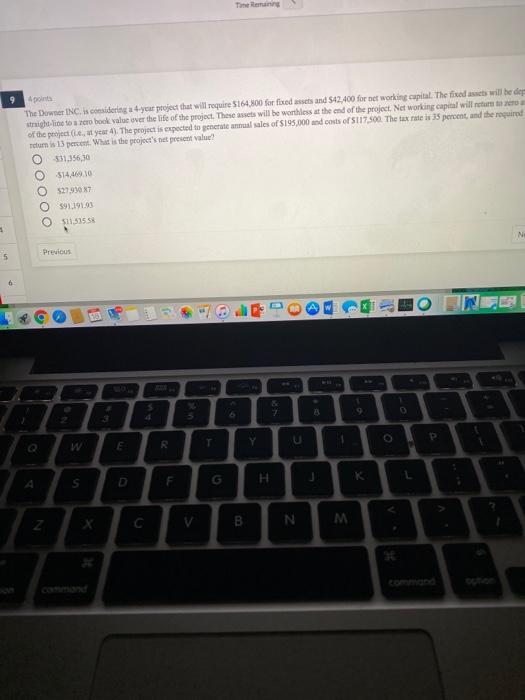

Question: Tien 9 The Down INC. is considering a 4-year project that will require $164,800 for fixed assets and 542,400 for net working capital. The fixed

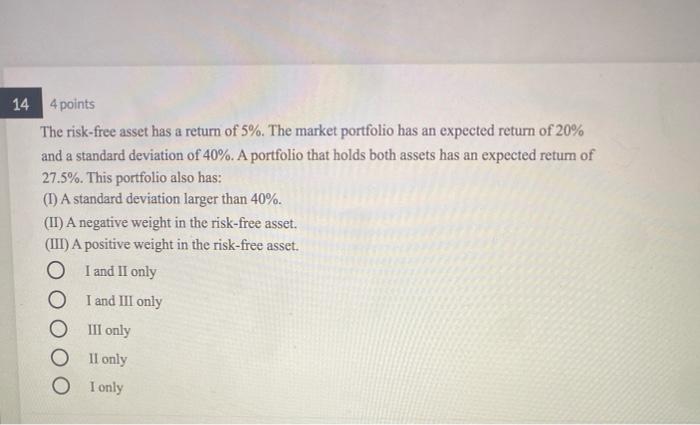

Tien 9 The Down INC. is considering a 4-year project that will require $164,800 for fixed assets and 542,400 for net working capital. The fixed it will be de straight-line torero book value over the life of the project. These assets will be worthless at the end of the project Networking capital will return to of the projecte a year 4). The project is expected to treate a sales of $195,000 and costs of 117.500. The tax rate is 35 percent, and the required return is 13 perces. What is the project's net pret value! 531356,30 514.469.10 5279307 591.19193 5115558 N 5 Previous 6 N s 2 B o P W E G D F . K L S C V B N M 14 4 points The risk-free asset has a return of 5%. The market portfolio has an expected return of 20% and a standard deviation of 40%. A portfolio that holds both assets has an expected return of 27.5%. This portfolio also has: (1) A standard deviation larger than 40%. (II) A negative weight in the risk-free asset. (III) A positive weight in the risk-free asset. O I and II only O I and III only III only II only I only

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts