Question: TIF Problem Eleven - 1 Exam Exercise Nineteen - 9 (Spousal Trusts And Income Allocation) Martime Flex died three years ago. At the time of

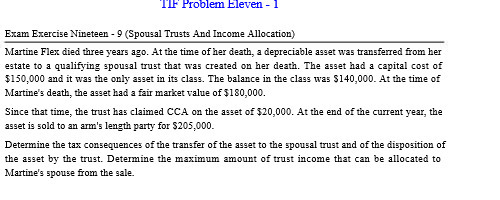

TIF Problem Eleven - 1 Exam Exercise Nineteen - 9 (Spousal Trusts And Income Allocation) Martime Flex died three years ago. At the time of her death, a depreciable asset was transferred from her estate to a qualifying spousal trust that was created on her death. The asset had a capital cost of $150,000 and it was the only asget in its class. The balance in the class was $140,000. At the time of Martine's death, the asget had a fair market value of $180,000. Since that time, the trust has claimed CCA on the asset of $20,000. At the end of the current year, the agget is sold to an arm's length party for $205,000. Determine the tax consequences of the transfer of the asget to the spousal trust and of the disposition of the asget by the trust. Determine the maximum amount of trust income that can be allocated to Martine's spouse from the gale

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts