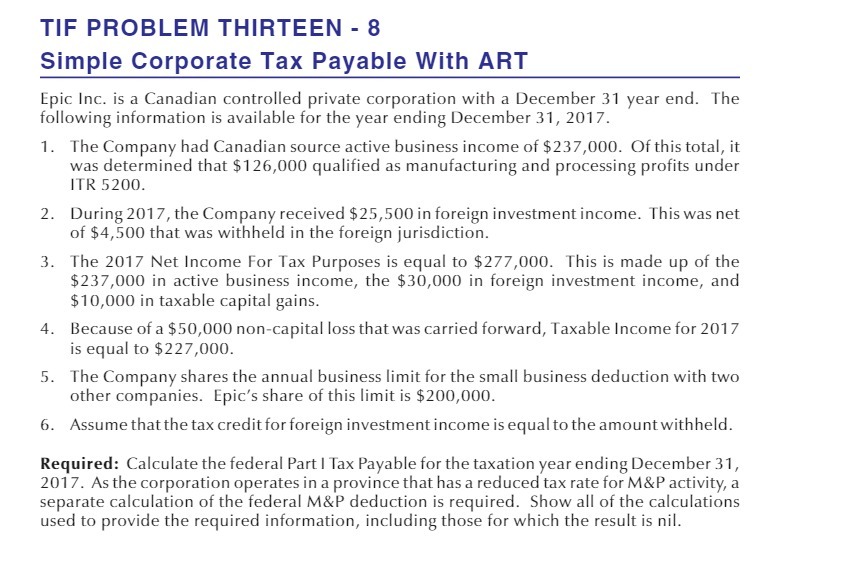

Question: TIF PROBLEM THIRTEEN - 8 Simple Corporate Tax Payable With ART Epic Inc. is a Canadian controlled private corporation with a December 31 year end.

TIF PROBLEM THIRTEEN - 8 Simple Corporate Tax Payable With ART Epic Inc. is a Canadian controlled private corporation with a December 31 year end. The following information is available for the year ending December 31, 201?. 1. The Company had Canadian source active business income of $237,000. Of this total, it was determined that $126,000 qualified as manufacturing and processing profits under ITR 52130. 2. During 201 71', the Company received $25,500 in foreign investment income. Thiswas net of $4,500 that was withheld in the foreign jurisdiction. 3. The 201? Net Income For Tax Purposes is equal to $2??,000. This is made up of the $237,000 in active business income, the $30,000 in foreign investment income, and $10,000 in taxable capital gains. 4. Because of a $50,000 non-capital loss thatwas carried forward, Taxable Income for 201}r is equal to $222,000. 5. The Company shares the annual business limit for the small business deduction with two other companies. Epic's share of this limit is $200,000- 5. Assu me that the tax creditfor foreign investment income is equal to the amount withheld. Required: Calculate the federal Part | Tax Payable for the taxation year ending December 31, 201 F". As the corporation operates in a province that has a reduced tax rate for MSxP activity, a separate calculation of the federal MScP deduction is required. Show all of the calculations used to provide the required information, including those for which the result is nil

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts