Question: Tim is considering purchasing a $500,000 life insurance policy. Tim is a 26-year-old single male with perfect health and no children. Which statements about Tim's

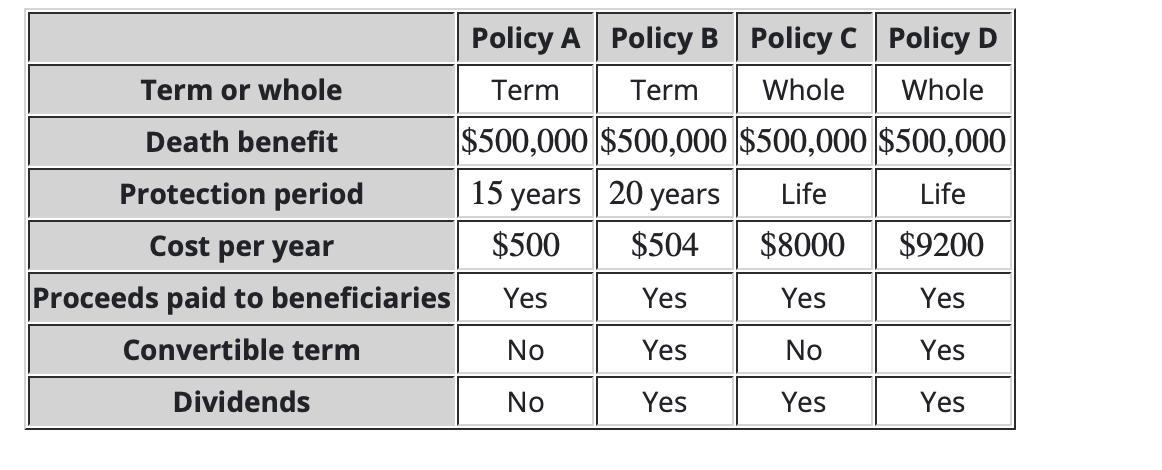

Tim is considering purchasing a $500,000 life insurance policy. Tim is a 26-year-old single male with perfect health and no children. Which statements about Tim's options are accurate? Select all that apply.

Whole life insurance is the best option because of Tim's age.

Policy A is the best option because it does not pay dividends.

Policy C is the best option because it is the cheapest whole-life policy.

Term life insurance is the best option because of Tim's age.

Policy B is the best option because the term is convertible.

Policy D is the best option because the term is convertible.

Term or whole Death benefit Protection period Cost per year Proceeds paid to beneficiaries Convertible term Dividends Policy A Policy B Policy C Policy D Term Term Whole Whole $500,000 $500,000 $500,000 $500,000 Life Life $8000 $9200 Yes Yes No Yes Yes Yes 15 years 20 years $500 $504 Yes Yes No Yes No Yes

Step by Step Solution

3.39 Rating (155 Votes )

There are 3 Steps involved in it

ANSWER B Policy A is the best option because it does not pay dividends A companys dividend policy di... View full answer

Get step-by-step solutions from verified subject matter experts