Question: Time 0 1 2 3 4 Cash Flow -5,000 3,000 2,000 1,000 3,000 Part 1: a. Compute the payback period and discounted payback period (using

Time 0 1 2 3 4

Cash Flow -5,000 3,000 2,000 1,000 3,000

Part 1:

a. Compute the payback period and discounted payback period (using a 10 percent discount rate) and then tell me if you would accept the project under either rule if the acceptable payback period is 2.5 years.

b. Compute the NPV using a 20-discount rate and tell me if you would accept the project and why.

c. Compute the IRR and then tell me if you would accept the project if the required rate of return is 20 percent and why.

d. Compute the Modified IRR, using a 10 percent reinvestment rate, and then tell me if you would accept the project if the required rate of return is 20 percent and why.

e. Compute the equivalent annual annuity with a 10 percent discount rate, and then tell me what the decision rule is if you are comparing these cash flows to another project.

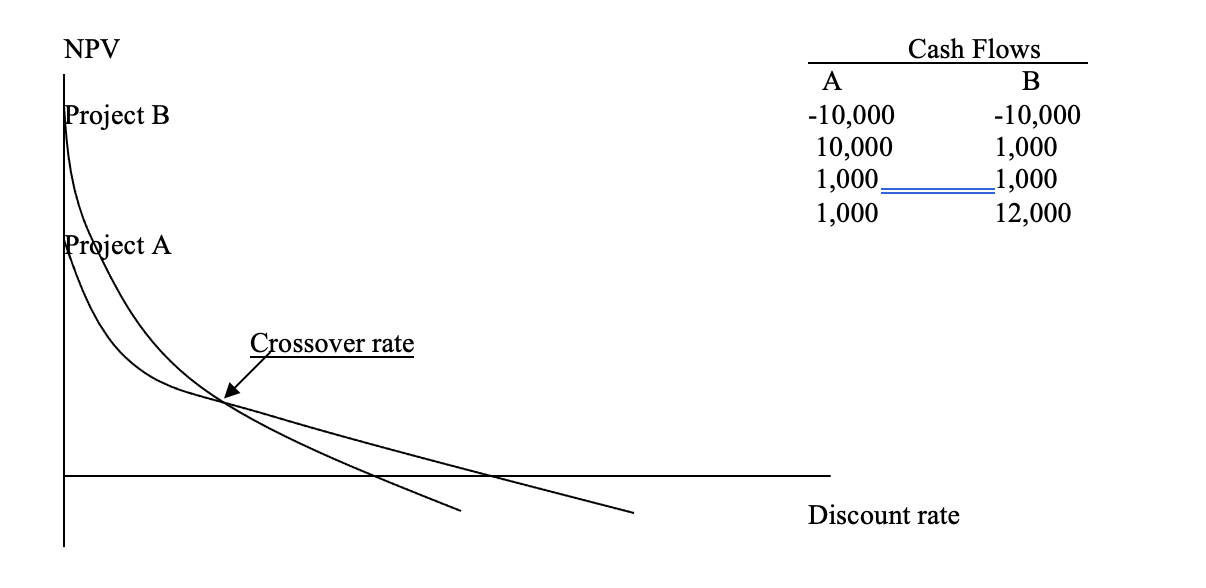

f. Label the axis with numbers for the 2 mutually exclusive projects (below), and then write a brief explanation of which project you would choose based on IRR and which you would choose based on NPV.

NPV Project B A -10,000 10,000 1,000 1,000 Cash Flows B -10,000 1,000 _1,000 12,000 Project A Crossover rate Discount rate

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts