Question: Time Als Question 1 (1 point Alexandre, 35, is self-employed as an IT security consultant. This year, his company had $200,000 in revenue and operating

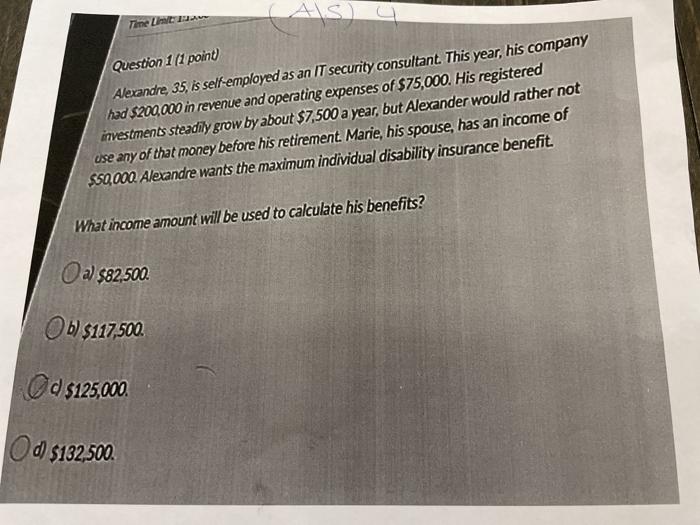

Time Als Question 1 (1 point Alexandre, 35, is self-employed as an IT security consultant. This year, his company had $200,000 in revenue and operating expenses of $75,000. His registered investments steadily grow by about $7,500 a year, but Alexander would rather not use any of that money before his retirement. Marie, his spouse, has an income of $50,000. Alexandre wants the maximum individual disability insurance benefit. What income amount will be used to calculate his benefits? a) $82,500 b) $117,500. Od $125,000 Od) $132,500

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts