Question: Time left 0 : 2 7 : 0 8 Carol is a self - employed seamstress who works from a home office, which is her

Time left ::

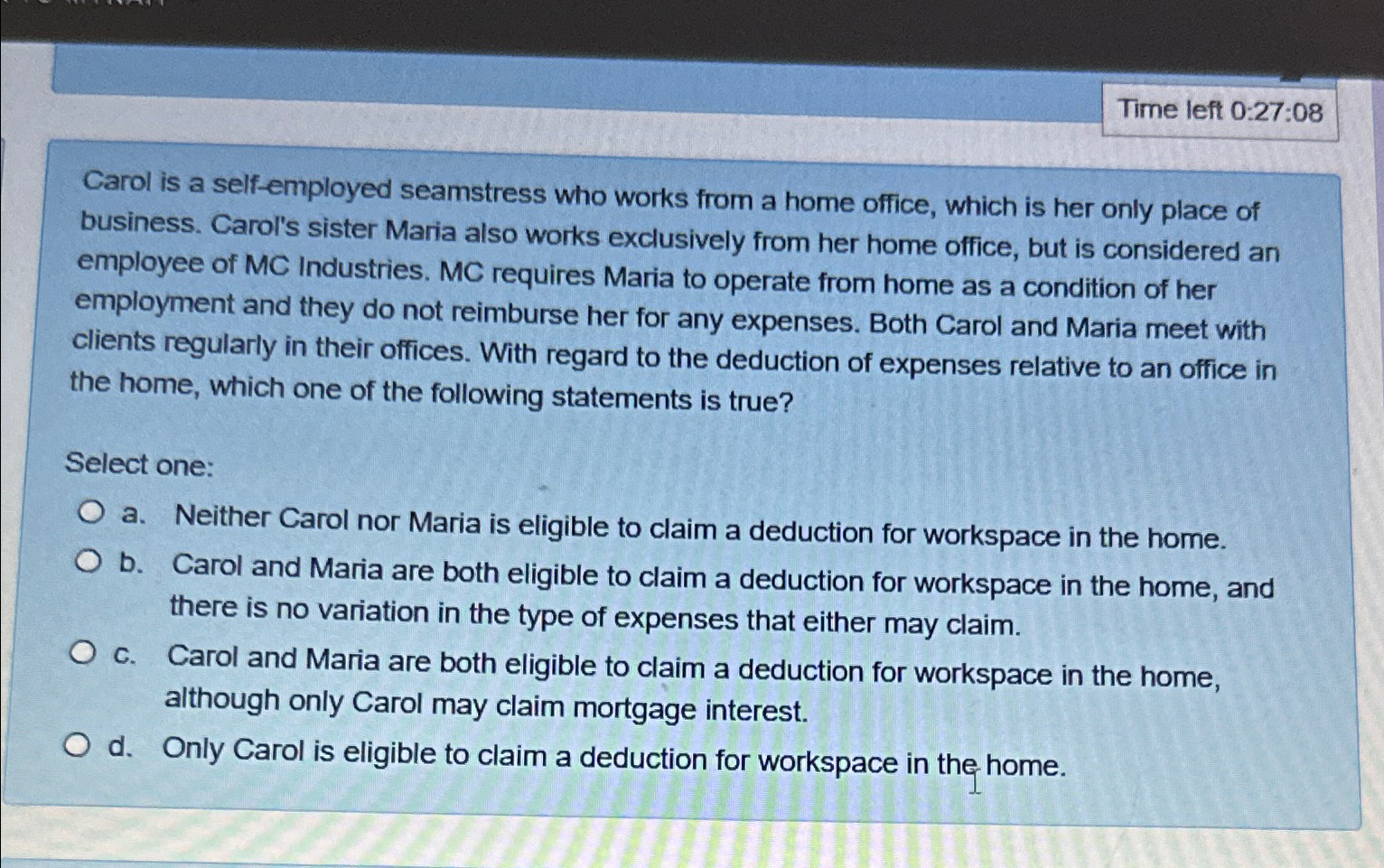

Carol is a selfemployed seamstress who works from a home office, which is her only place of business. Carol's sister Maria also works exclusively from her home office, but is considered an employee of MC Industries. MC requires Maria to operate from home as a condition of her employment and they do not reimburse her for any expenses. Both Carol and Maria meet with clients regularly in their offices. With regard to the deduction of expenses relative to an office in the home, which one of the following statements is true?

Select one:

a Neither Carol nor Maria is eligible to claim a deduction for workspace in the home.

b Carol and Maria are both eligible to claim a deduction for workspace in the home, and there is no variation in the type of expenses that either may claim.

c Carol and Maria are both eligible to claim a deduction for workspace in the home, although only Carol may claim mortgage interest.

d Only Carol is eligible to claim a deduction for workspace in the home.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock