Question: Time left 0 : 3 0 : 1 9 An individual who resides in Saskatchewan has not filed her 2 0 1 9 , 2

Time left ::

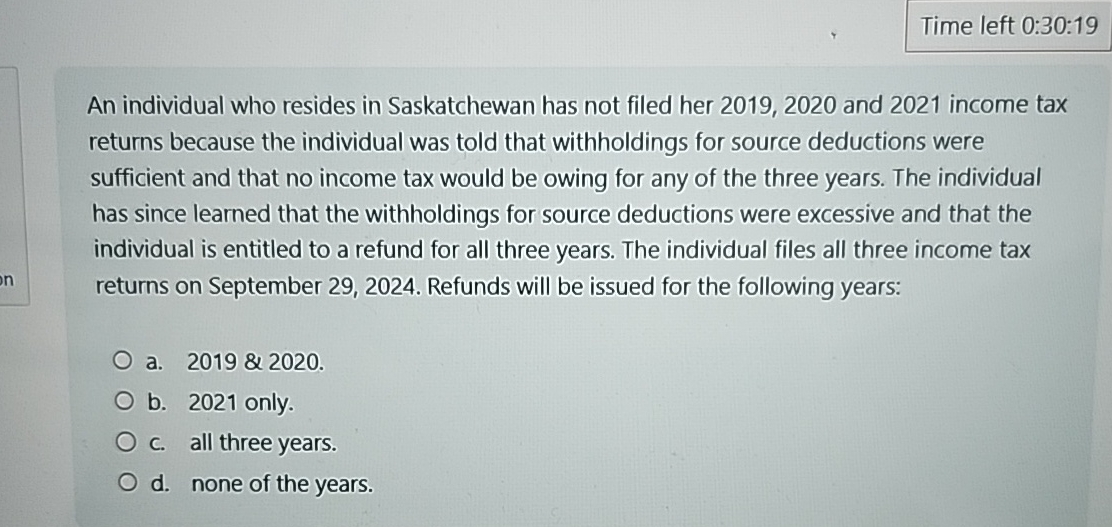

An individual who resides in Saskatchewan has not filed her and income tax returns because the individual was told that withholdings for source deductions were sufficient and that no income tax would be owing for any of the three years. The individual has since learned that the withholdings for source deductions were excessive and that the individual is entitled to a refund for all three years. The individual files all three income tax returns on September Refunds will be issued for the following years:

a&

b only.

c all three years.

d none of the years.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock