Question: Time left 0 : 5 6 : 3 8 Question 2 Not yet answered Marked out of 2 . 0 0 Flag question Energy Australia

Time left ::

Question

Not yet

answered

Marked out of

Flag question

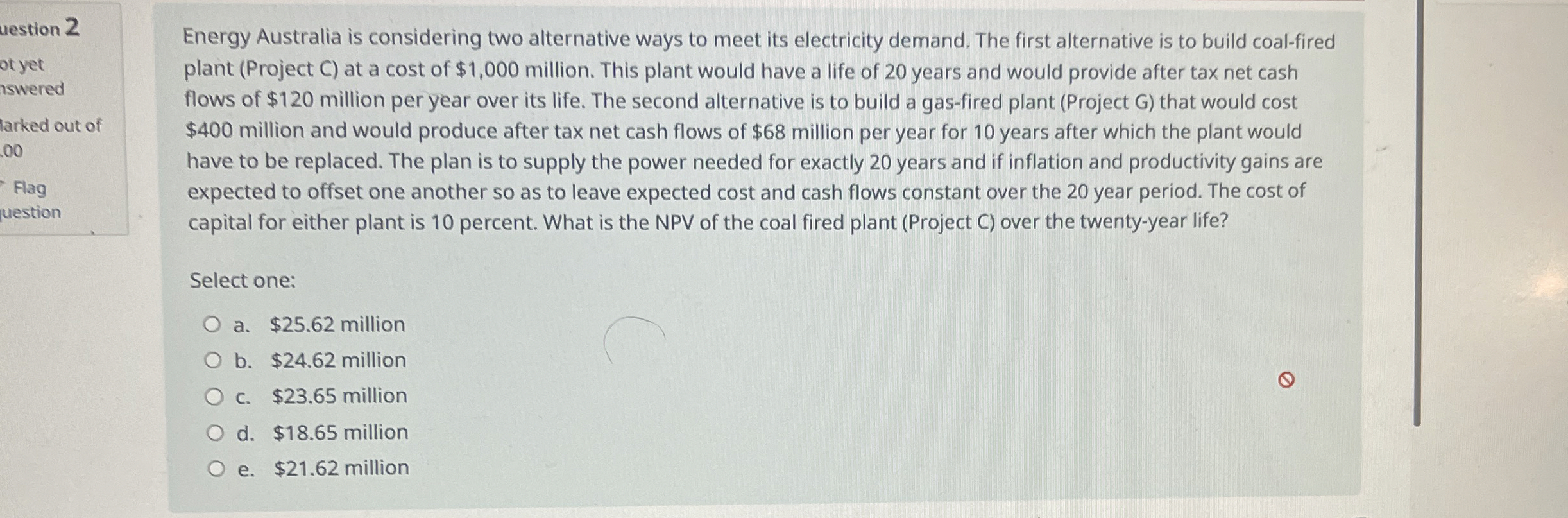

Energy Australia is considering two alternative ways to meet its electricity demand. The first alternative is to build coalfired plant Project C at a cost of $ million. This plant would have a life of years and would provide after tax net cash flows of $ million per year over its life. The second alternative is to build a gasfired plant Project G that would cost $ million and would produce after tax net cash flows of $ million per year for years after which the plant would have to be replaced. The plan is to supply the power needed for exactly years and if inflation and productivity gains are expected to offset one another so as to leave expected cost and cash flows constant over the year period. The cost of capital for either plant is percent. What is the NPV of the coal fired plant Project C over the twentyyear life?

Select one:

a $ million

b $ million

c $ million

d $ million

e $ million

uestion ot yet iswered larked out of

Flag

uestion

Energy Australia is considering two alternative ways to meet its electricity demand. The first alternative is to build coalfired plant Project C at a cost of $ million. This plant would have a life of years and would provide after tax net cash flows of $ million per year over its life. The second alternative is to build a gasfired plant Project G that would cost $ million and would produce after tax net cash flows of $ million per year for years after which the plant would have to be replaced. The plan is to supply the power needed for exactly years and if inflation and productivity gains are expected to offset one another so as to leave expected cost and cash flows constant over the year period. The cost of capital for either plant is percent. What is the NPV of the coal fired plant Project C over the twentyyear life?

Select one:

a $ million

b $ million

c $ million

d $ million

e $ million

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock