Question: Time left 0 : 5 7 : 1 4 Question 2 Not yet answered Marked out of 1 . 0 0 Flag question Loral Co

Time left ::

Question

Not yet answered

Marked out of

Flag question

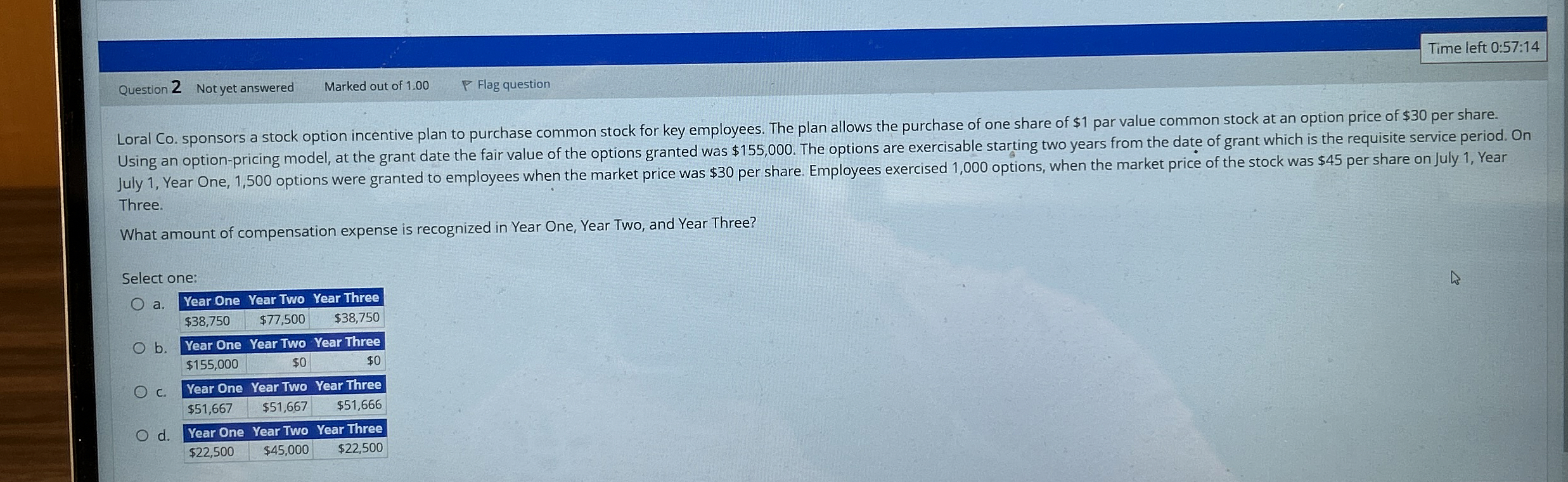

Loral Co sponsors a stock option incentive plan to purchase common stock for key employees. The plan allows the purchase of one share of $ par value common stock at an option price of $ per share. Using an optionpricing model, at the grant date the fair value of the options granted was $ The options are exercisable starting two years from the date of grant which is the requisite service period. On July Year One, options were granted to employees when the market price was $ per share. Employees exercised options, when the market price of the stock was $ per share on July Year Three.

What amount of compensation expense is recognized in Year One, Year Two, and Year Three?

Select one:

a Year One Year Two Year Three

b

tableYear One,Year Two,Year T$$$

c

tableYear One,Year Two,Year Three$$$

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock