Question: Time left 1 : 1 0 : 3 0 Question 3 Not yet answered Marked out of 3 . 0 0 Flag question Based on

Time left ::

Question

Not yet answered

Marked out of

Flag question

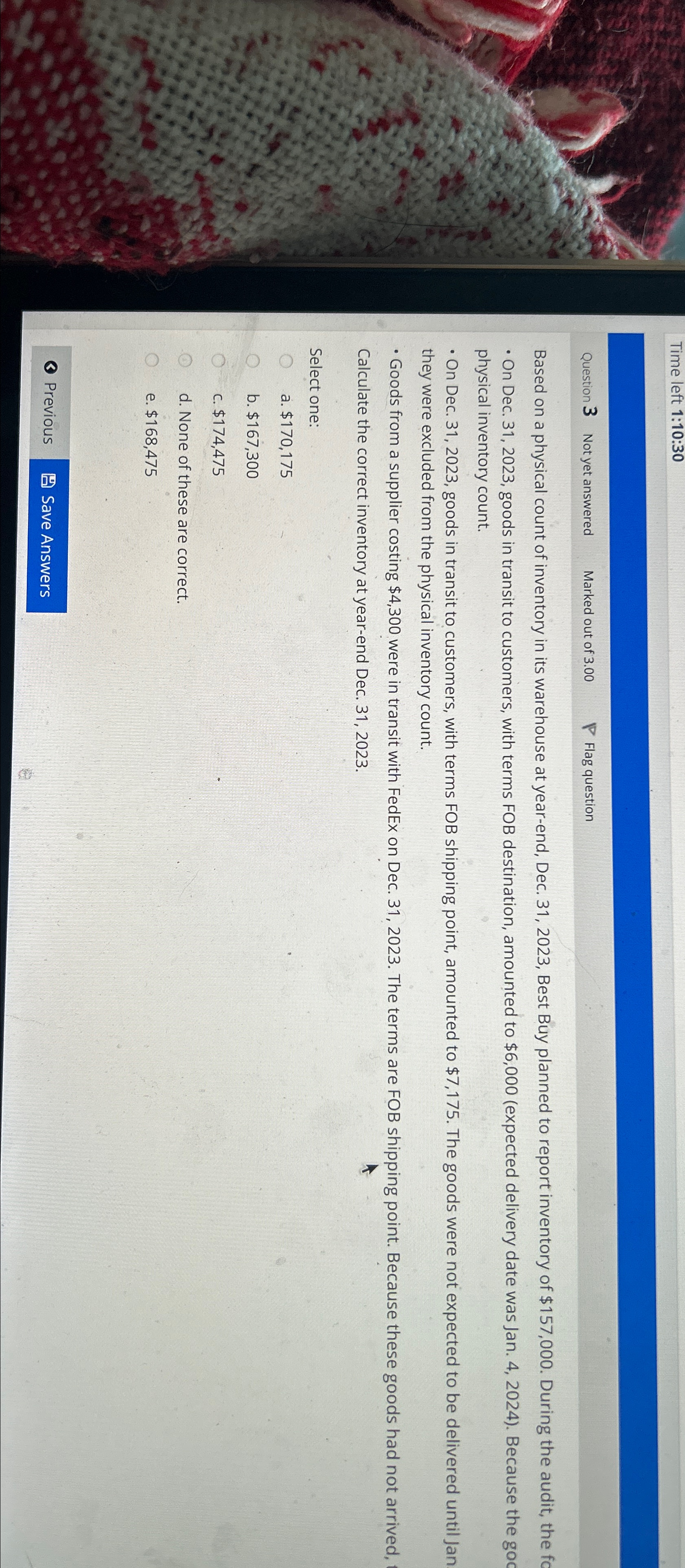

Based on a physical count of inventory in its warehouse at yearend, Dec. Best Buy planned to report inventory of $ During the audit, the fo On Dec. goods in transit to customers, with terms FOB destination, amounted to $expected delivery date was Jan. Because the goc physical inventory count.

On Dec. goods in transit to customers, with terms FOB shipping point, amounted to $ The goods were not expected to be delivered until Jan they were excluded from the physical inventory count.

Goods from a supplier costing $ were in transit with FedEx on Dec. The terms are FOB shipping point. Because these goods had not arrived, Calculate the correct inventory at yearend Dec.

Select one:

a $

b $

c $

d None of these are correct.

e $

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock