Question: Time left 1 : 5 9 : 2 9 Question 1 Not yet answered Marked out of 3 . 0 0 Flag question Alex and

Time left ::

Question

Not yet answered

Marked out of

Flag question

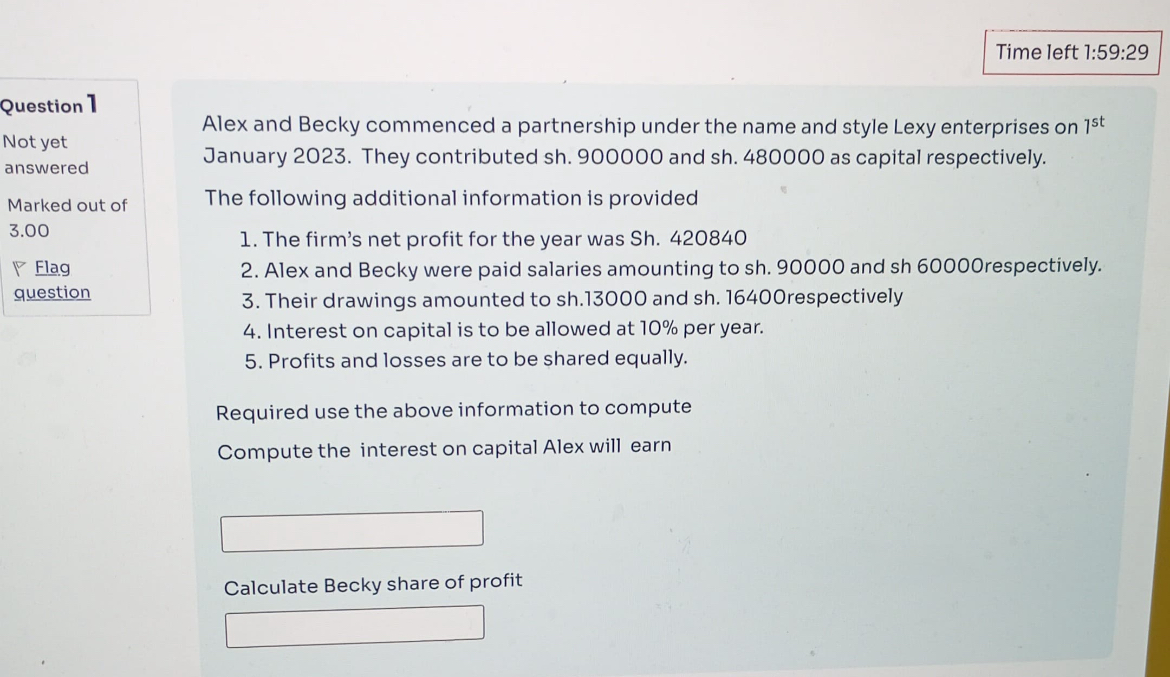

Alex and Becky commenced a partnership under the name and style Lexy enterprises on January They contributed sh and sh as capital respectively.

The following additional information is provided

The firm's net profit for the year was Sh

Alex and Becky were paid salaries amounting to sh and sh respectively.

Their drawings amounted to sh and sh respectively

Interest on capital is to be allowed at per year.

Profits and losses are to be shared equally.

Required use the above information to compute

Compute the interest on capital Alex will earn

Calculate Becky share of profit

Time left ::

Question

Not yet answered

Marked out of

Flag question

Alex and Becky commenced a partnership under the name and style Lexy enterprises on January They contributed sh and sh as capital respectively.

The following additional information is provided

The firm's net profit for the year was Sh

Alex and Becky were paid salaries amounting to sh and sh respectively.

Their drawings amounted to sh and sh respectively

Interest on capital is to be allowed at per year.

Profits and losses are to be shared equally.

Required use the above information to compute

Compute the interest on capital Alex will earn

Calculate Becky share of profit

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock