Question: Time left 1:18:57 Information P Flag question Part C:1 Case Analysis (1*20=20 Marks) Question 4 Mr Geetashu, Finance Manager, Jenpac Ltd. is evaluating two projects

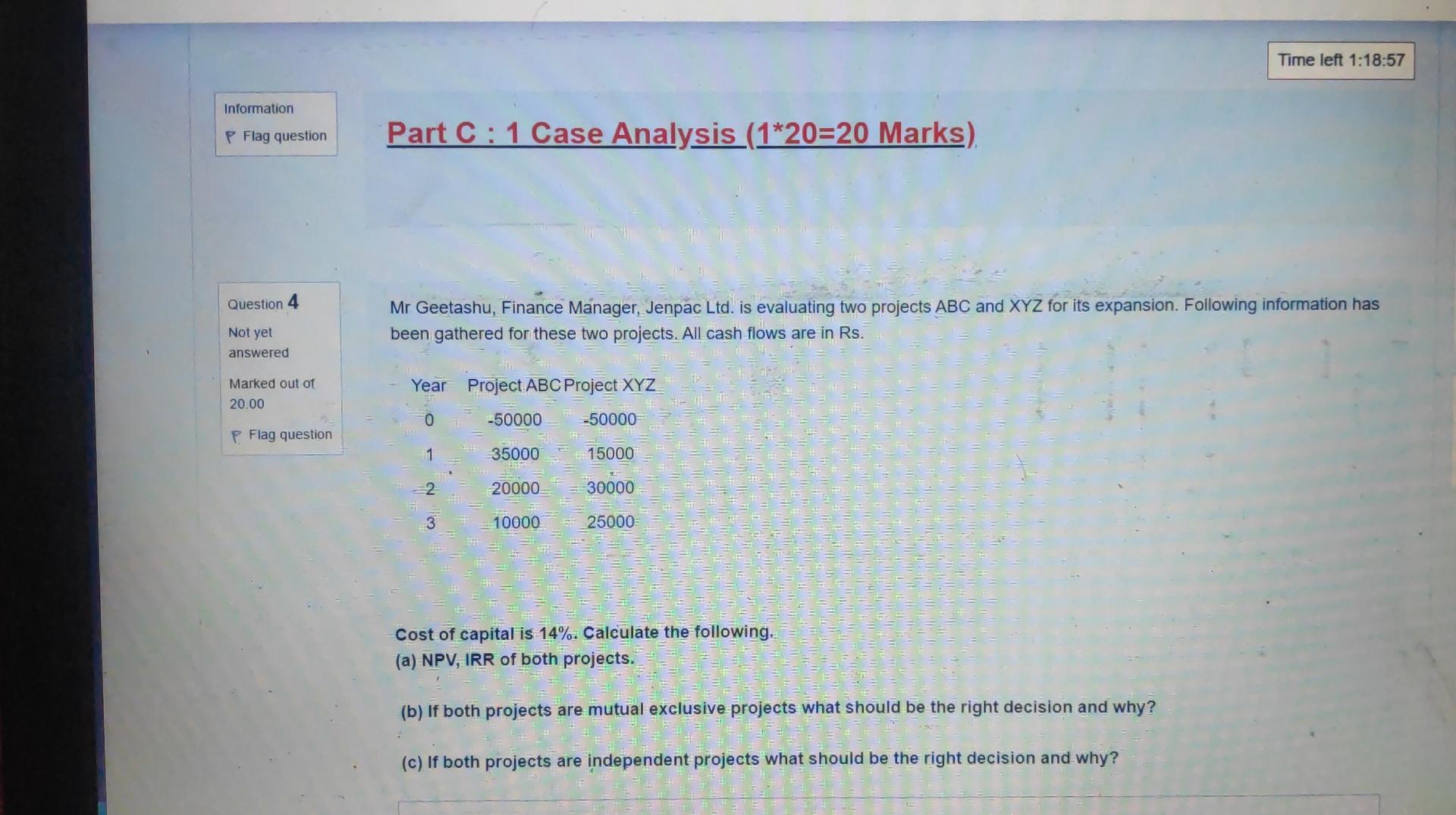

Time left 1:18:57 Information P Flag question Part C:1 Case Analysis (1*20=20 Marks) Question 4 Mr Geetashu, Finance Manager, Jenpac Ltd. is evaluating two projects ABC and XYZ for its expansion. Following information has been gathered for these two projects. All cash flows are in Rs. Not yet answered Marked out of 20.00 Year Project ABC Project XYZ 0 -50000 -50000 P Flag question 1 35000 15000 20000 30000 10000 25000 Cost of capital is 14%. Calculate the following. (a) NPV, IRR of both projects. (b) If both projects are mutual exclusive projects what should be the right decision and why? (c) If both projects are independent projects what should be the right decision and why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts