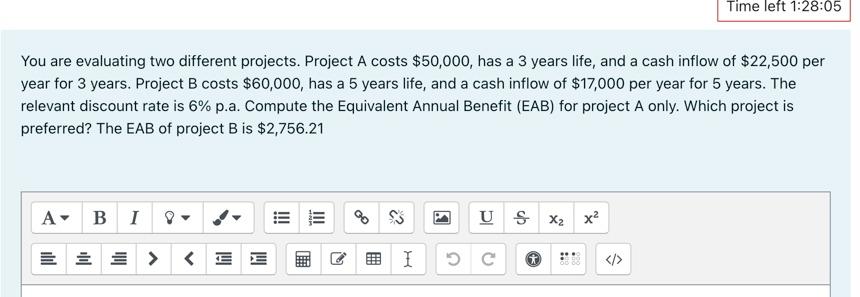

Question: Time left 1:28:05 You are evaluating two different projects. Project A costs $50,000, has a 3 years life, and a cash inflow of $22,500 per

Time left 1:28:05 You are evaluating two different projects. Project A costs $50,000, has a 3 years life, and a cash inflow of $22,500 per year for 3 years. Project B costs $60,000, has a 5 years life, and a cash inflow of $17,000 per year for 5 years. The relevant discount rate is 6% p.a. Compute the equivalent Annual Benefit (EAB) for project A only. Which project is preferred? The EAB of project B is $2,756.21 A BIO U X2 x >

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts