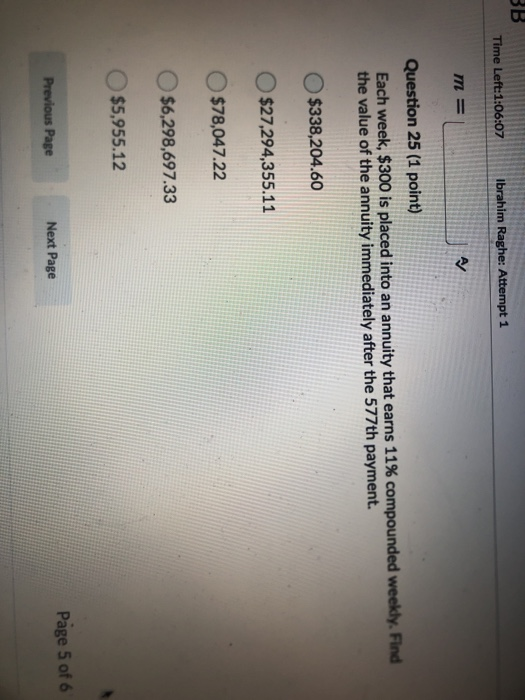

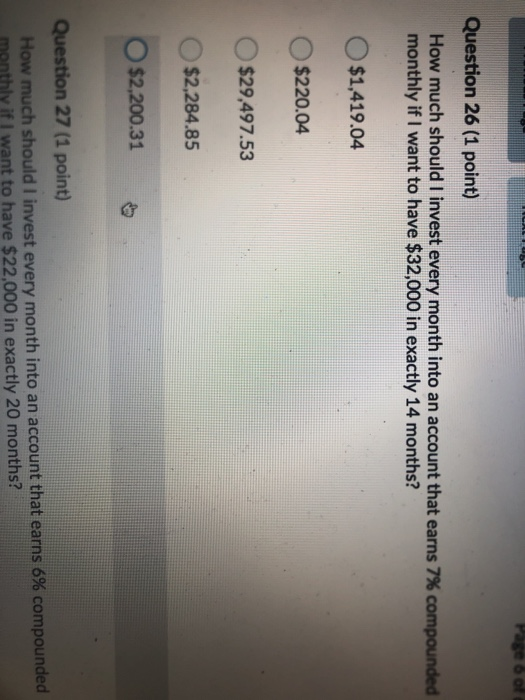

Question: Time Left:1:06:07 Ibrahim Raghe: Attempt 1 m = Question 25 (1 point) Each week, $300 is placed into an annuity that earns 11% compounded weekly.

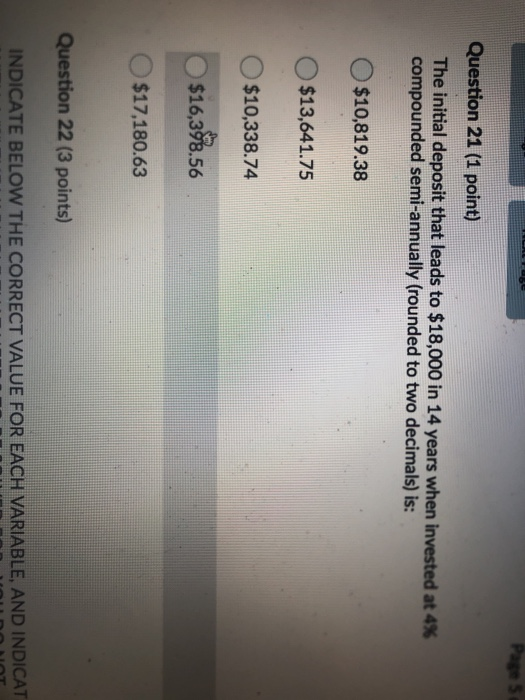

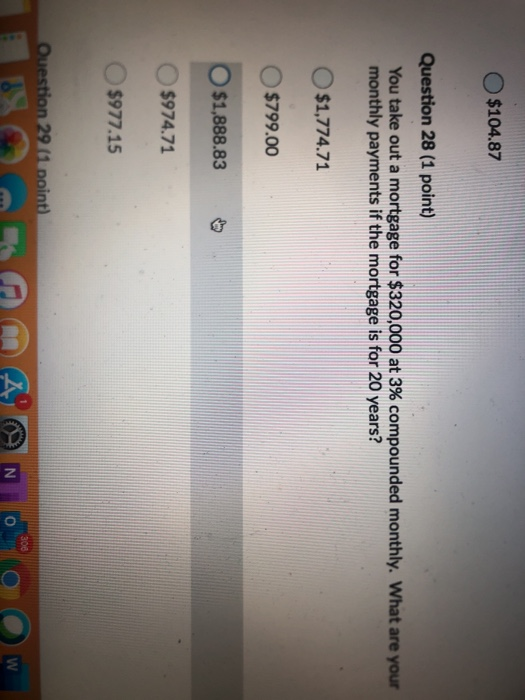

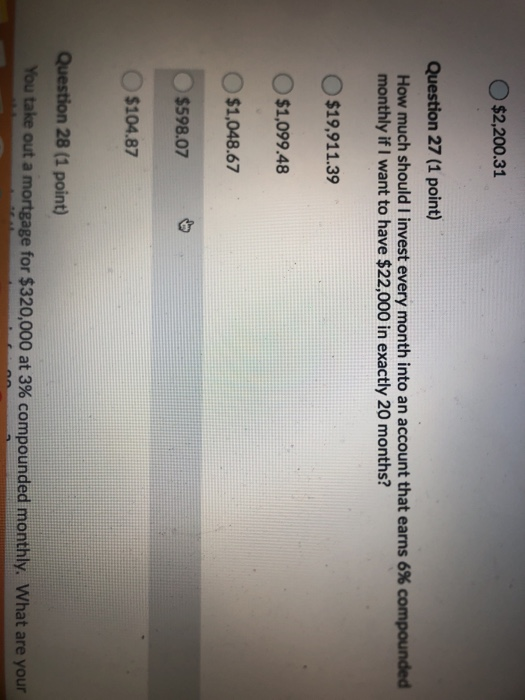

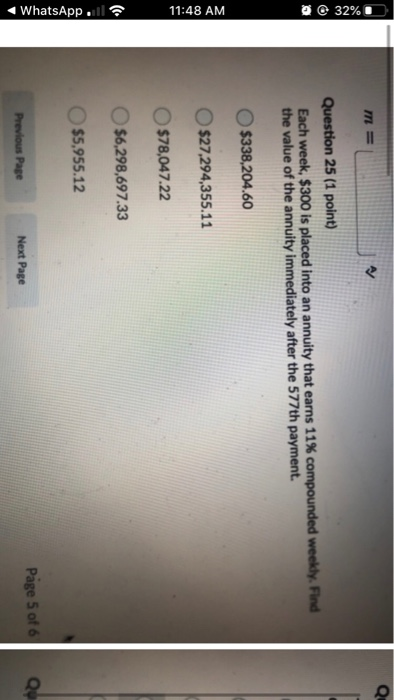

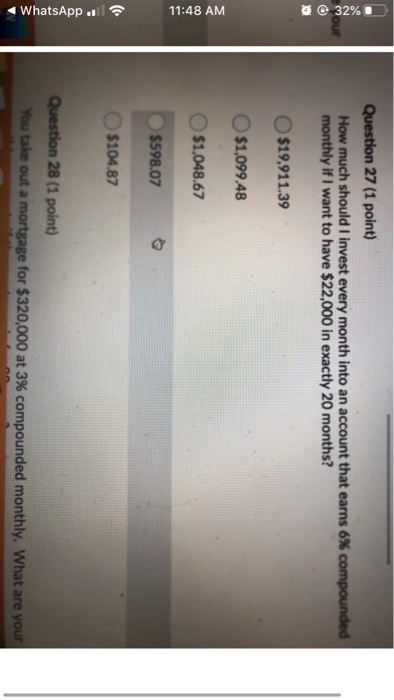

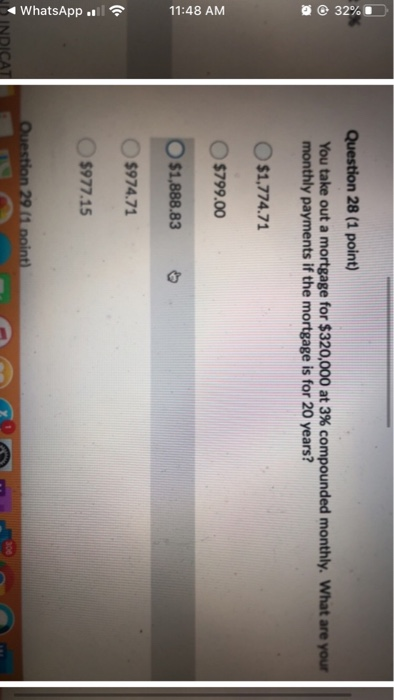

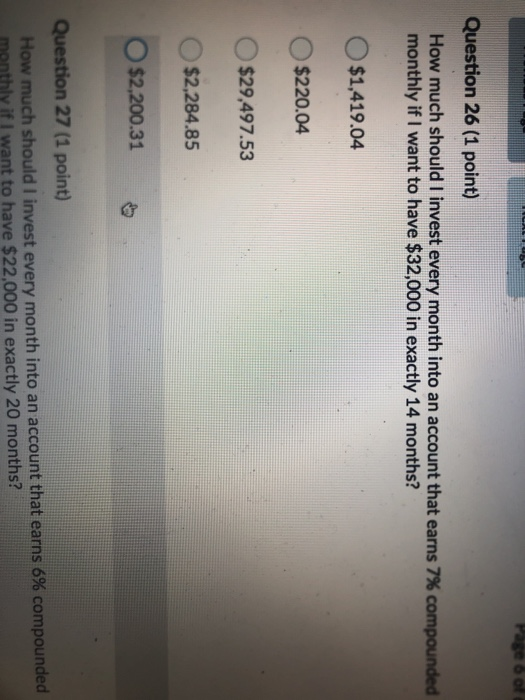

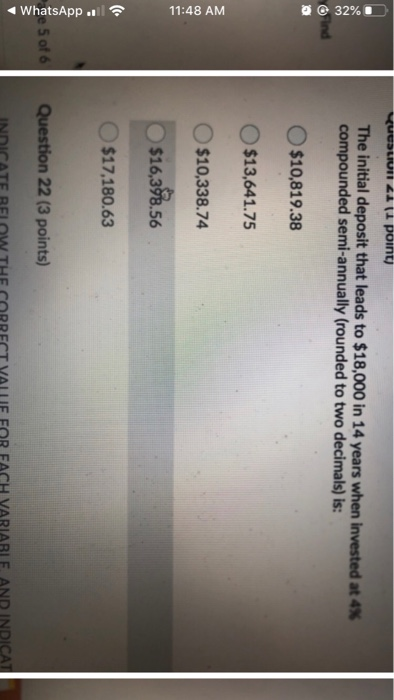

Time Left:1:06:07 Ibrahim Raghe: Attempt 1 m = Question 25 (1 point) Each week, $300 is placed into an annuity that earns 11% compounded weekly. Find the value of the annuity immediately after the 577th payment. $338,204.60 $27,294,355.11 $78,047.22 $6,298,697.33 $5,955.12 Page 5 of 6 Previous Page Next Page Page 5 Question 21 (1 point) The initial deposit that leads to $18,000 in 14 years when invested at 4% compounded semi-annually (rounded to two decimals) is: $10,819.38 O $13,641.75 O $10,338.74 $16,398.56 $17,180.63 Question 22 (3 points) INDICATE BELOW THE CORRECT VALUE FOR EACH VARIABLE, AND INDICAT online $104.87 Question 28 (1 point) You take out a mortgage for $320,000 at 3% compounded monthly. What are your monthly payments if the mortgage is for 20 years? $1,774.71 $799.00 O $1,888.83 $974.71 $977.15 Question 29 (1 point) KA AY NOW $2,200.31 Question 27 (1 point) How much should I invest every month into an account that earns 6% compounded monthly if I want to have $22,000 in exactly 20 months? $19,911.39 O $1,099.48 $1,048.67 $598.07 $104.87 Question 28 (1 point) ou take out a mortgage for $320,000 at 3% compounded monthly. What are your Page 6 of Question 26 (1 point) How much should I invest every month into an account that earns 7% compounded monthly if I want to have $32,000 in exactly 14 months? $1,419.04 $220.04 $29,497.53 $2,284.85 O $2,200.31 Question 27 (1 point) How much should I invest every month into an account that earns 6% compounded monthly if I want to have $22,000 in exactly 20 months? M @ 32%D Question 25 (1 point) Each week. $300 is placed into an annuity that earns 11% compounded weekly. the value of the annuity immediately after the 577th payment. $338,204.60 11:48 AM $27,294,355.11 $78,047.22 $6,298,697.33 $5,955.12 WhatsApp Page 5 of 6 Previous Page Next Page 32% Question 27 (1 point) How much should I invest every month into an account that earns 6% compounded monthly if I want to have $22,000 in exactly 20 months? $19,911.39 $1,099.48 11:48 AM $1,048.67 $598.07 $104.87 WhatsApp. Question 28 (1 point) You take out a mortgage for $320,000 at 3% compounded monthly. What are your @ 32% Question 28 (1 point) You take out a mortgage for $320,000 at 3% compounded monthly. What are your monthly payments if the mortgage is for 20 years? O$1,774.71 $799.00 11:48 AM $1,888.83 $974.71 $977.15 WhatsApp Question 29 (1 point) Page 6 of Question 26 (1 point) How much should I invest every month into an account that earns 7% compounded monthly if I want to have $32,000 in exactly 14 months? $1,419.04 O $220.04 $29,497.53 $2,284.85 $2,200.31 Question 27 (1 point) How much should I invest every month into an account that earns 6% compounded monthly if I want to have $22,000 in exactly 20 months? US 44 14 point The initial deposit that leads to $18,000 in 14 years when invested at 4 compounded semi-annually (rounded to two decimals) is: 32% $10,819.38 $13,641.75 11:48 AM $10,338.74 $16,398.56 $17,180.63 * WhatsApp . Question 22 (3 points) INDICATE RFLOW THE CORRECT VALUE FOR EACH VARIARIE AND INDICAT

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts