Question: Time Left:1:51:05 PBY Long Question Question 9 (21 points) You wish to purchase an apartment for your family. Your family's annul income is a net

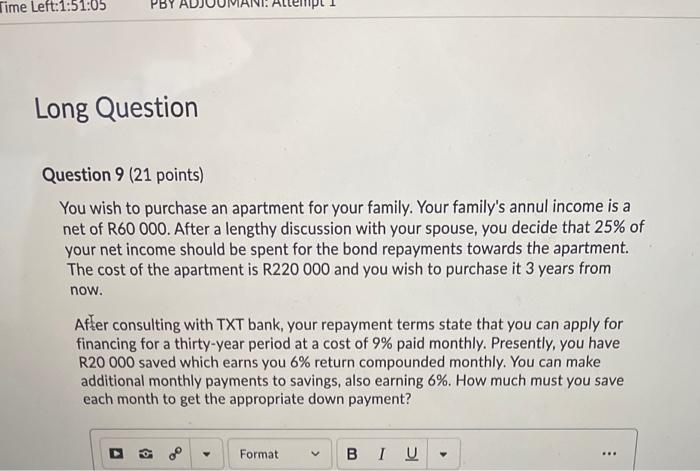

Time Left:1:51:05 PBY Long Question Question 9 (21 points) You wish to purchase an apartment for your family. Your family's annul income is a net of R60 000. After a lengthy discussion with your spouse, you decide that 25% of your net income should be spent for the bond repayments towards the apartment. The cost of the apartment is R220 000 and you wish to purchase it 3 years from now. After consulting with TXT bank, your repayment terms state that you can apply for financing for a thirty-year period at a cost of 9% paid monthly. Presently, you have R20 000 saved which earns you 6% return compounded monthly. You can make additional monthly payments to savings, also earning 6%. How much must you save each month to get the appropriate down payment? 10 Format BIU

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts