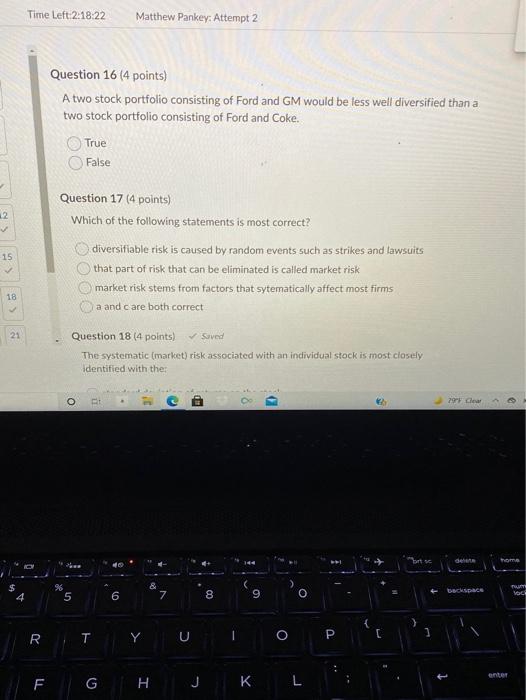

Question: Time Left:2:18:22 Matthew Pankey: Attempt 2 Question 16 (4 points) A two stock portfolio consisting of Ford and GM would be less well diversified than

Time Left:2:18:22 Matthew Pankey: Attempt 2 Question 16 (4 points) A two stock portfolio consisting of Ford and GM would be less well diversified than a two stock portfolio consisting of Ford and Coke. True False Question 17 (4 points) 2 Which of the following statements is most correct? diversifiable risk is caused by random events such as strikes and lawsuits 15 that part of risk that can be eliminated is called market risk market risk stems from factors that sytematically affect most firms 18 a and care both correct 21 Question 18 (4 points) saved The systematic (market) risk associated with an individual stock is most closely identified with the O 79 Cew bort des Tome 36 5 & 7 9 LE re Wat 6 8 O Y RT PC O ten F G H J K L

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts