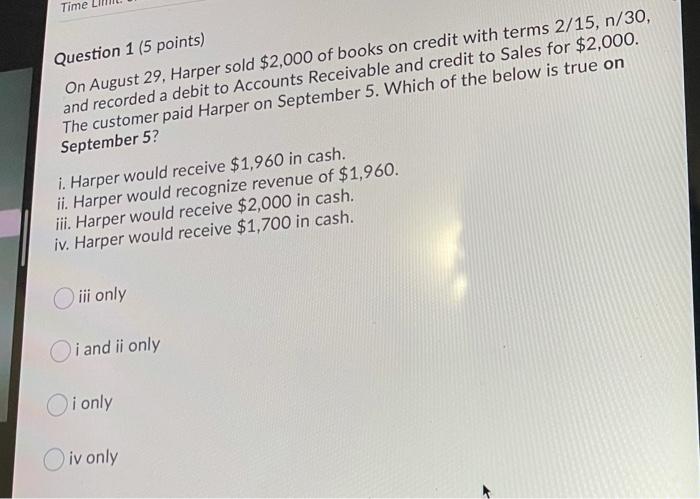

Question: Time Question 1 (5 points) On August 29, Harper sold $2,000 of books on credit with terms 2/15, n/30, and recorded a debit to Accounts

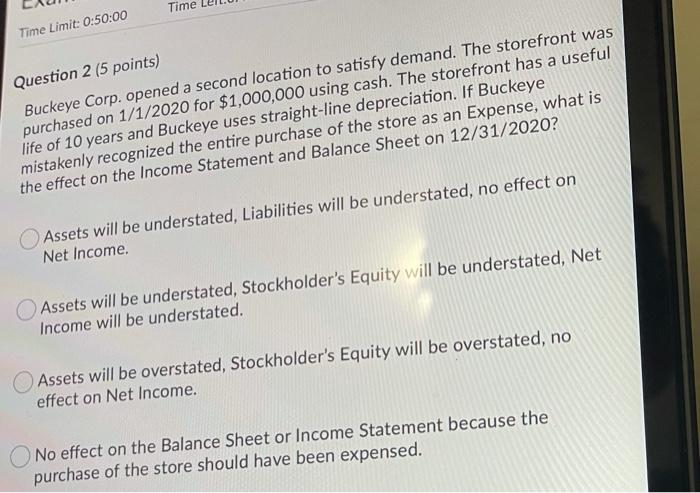

Time Question 1 (5 points) On August 29, Harper sold $2,000 of books on credit with terms 2/15, n/30, and recorded a debit to Accounts Receivable and credit to Sales for $2,000. The customer paid Harper on September 5. Which of the below is true on September 52 i. Harper would receive $1,960 in cash. ii. Harper would recognize revenue of $1,960. iii. Harper would receive $2,000 in cash. iv. Harper would receive $1,700 in cash. iii only Oi and ii only i only iv only Time Time Limit: 0:50:00 Question 2 (5 points) Buckeye Corp. opened a second location to satisfy demand. The storefront was purchased on 1/1/2020 for $1,000,000 using cash. The storefront has a useful life of 10 years and Buckeye uses straight-line depreciation. If Buckeye mistakenly recognized the entire purchase of the store as an Expense, what is the effect on the Income Statement and Balance Sheet on 12/31/2020? Assets will be understated, Liabilities will be understated, no effect on Net Income. Assets will be understated, Stockholder's Equity will be understated, Net Income will be understated. Assets will be overstated, Stockholder's Equity will be overstated, no effect on Net Income. No effect on the Balance Sheet or Income Statement because the purchase of the store should have been expensed

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts