Question: Time Remaining: 01:14:23 Submit Test This Question: 1 pt 5 of 21 (15 complete) This Test: 21 pts possibl (Weighted average cost of capital) The

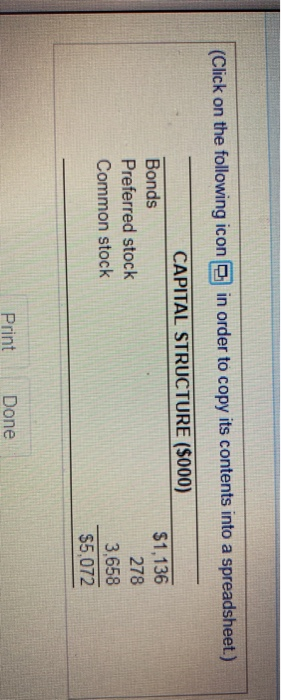

Time Remaining: 01:14:23 Submit Test This Question: 1 pt 5 of 21 (15 complete) This Test: 21 pts possibl (Weighted average cost of capital) The capital structure for the Carion Corporation is provided here: The company plans to maintain its debt structure in the future. If the firm has an after-tax cost of debt of 6.8 percent, a cost of preferred stock of 12 3 percent, and a cost of common stock of 16.7 percent, what is the firm's weighted average cost of capital? The firm's weighted average cost of capital is % (Round to two decimal places) (Click on the following icon in order to copy its contents into a spreadsheet.) CAPITAL STRUCTURE ($000) Bonds Preferred stock Common stock $1,136 278 3,658 $5,072 Print Done

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts