Question: time sensitive - 2 hours left. Exercise 13A-1 (Algo) Absorption Costing Approach to Cost-Plus Pricing (LO13-8] Martin Company uses the absorption costing approach to cost-plus

time sensitive - 2 hours left.

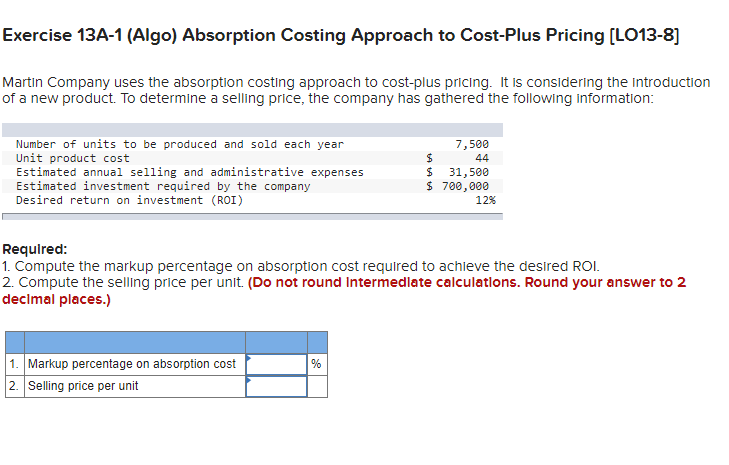

Exercise 13A-1 (Algo) Absorption Costing Approach to Cost-Plus Pricing (LO13-8] Martin Company uses the absorption costing approach to cost-plus pricing. It is considering the introduction of a new product. To determine a selling price, the company has gathered the following information: Number of units to be produced and sold each year Unit product cost Estimated annual selling and administrative expenses Estimated investment required by the company Desired return on investment (ROI) 7,500 $ 44 $ 31,500 $ 700,000 12% Required: 1. Compute the markup percentage on absorption cost required to achieve the desired ROI. 2. Compute the selling price per unit. (Do not round Intermediate calculations. Round your answer to 2 decimal places.) % 1. Markup percentage on absorption cost 2. Selling price per unit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts