Question: **TIME SENSITIVE** please, make sure your answer is correct & solve by 2:30pm thank you so much! AFW Industries has 204 million shares outstanding and

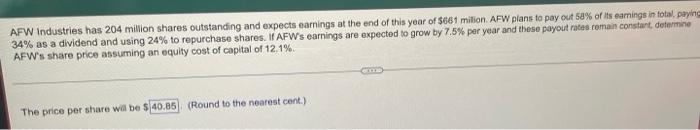

AFW Industries has 204 million shares outstanding and expects earnings at the end of this year of $661 milion AFW plans to pay out 53% of its earnings in total, paying 34% as a dividend and using 24% to repurchase shares. If AFW's earnings are expected to grow by 7.5% per year and these payout rates romain constant determine AFW's share price assuming an equity cost of capital of 12.1%. The price per share will be $40.85 (Round to the nearest cont.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts