Question: Time Series Practice Suppose {rt} represents the continuously compounded weekly return on a stock such that each return is independently identically distributed as a normal

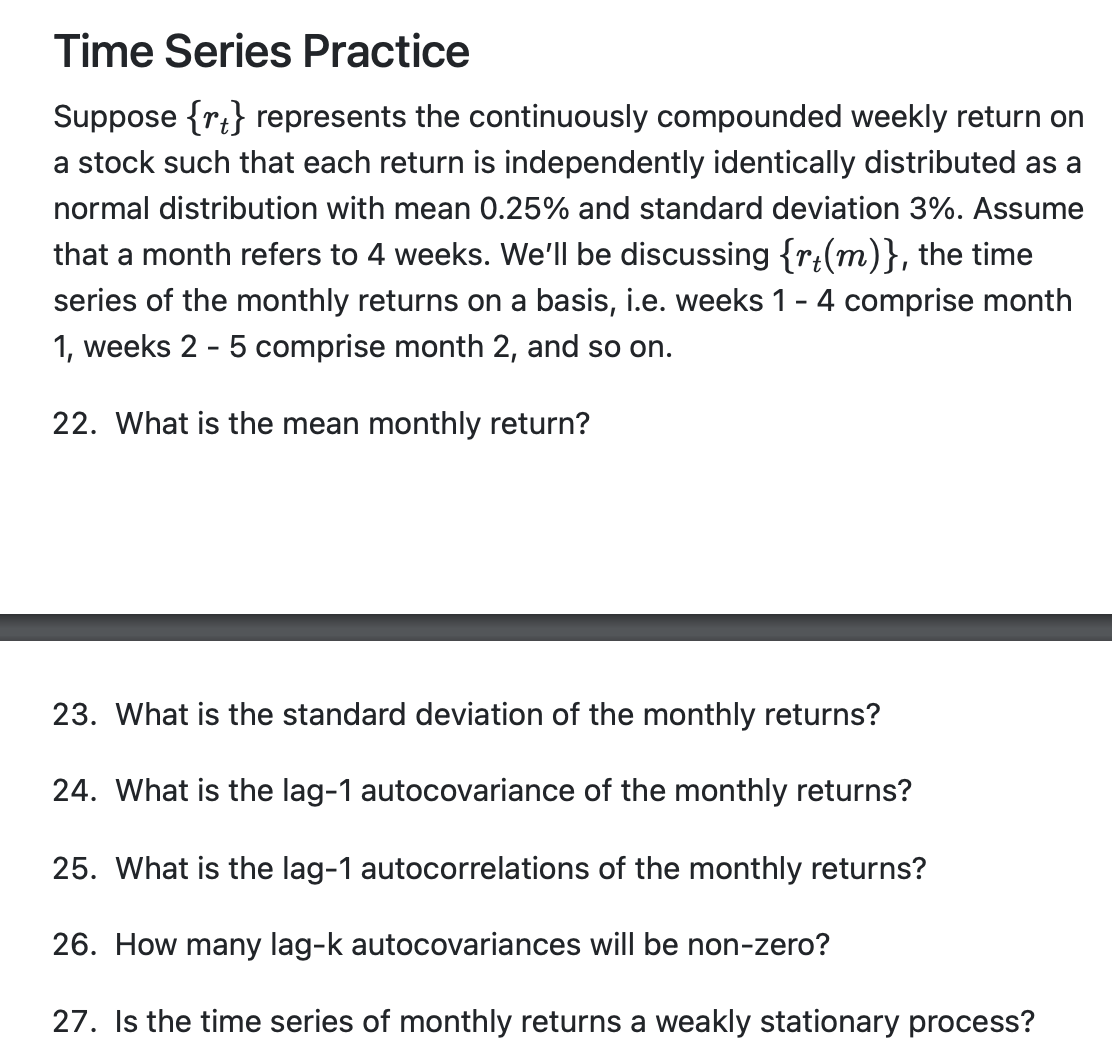

Time Series Practice Suppose {rt} represents the continuously compounded weekly return on a stock such that each return is independently identically distributed as a normal distribution with mean 0.25% and standard deviation 3%. Assume that a month refers to 4 weeks. We'll be discussing {rt(m)}, the time series of the monthly returns on a basis, i.e. weeks 14 comprise month 1 , weeks 2 - 5 comprise month 2 , and so on. 22. What is the mean monthly return? 23. What is the standard deviation of the monthly returns? 24. What is the lag-1 autocovariance of the monthly returns? 25. What is the lag-1 autocorrelations of the monthly returns? 26. How many lag-k autocovariances will be non-zero? 27. Is the time series of monthly returns a weakly stationary process

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts